Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

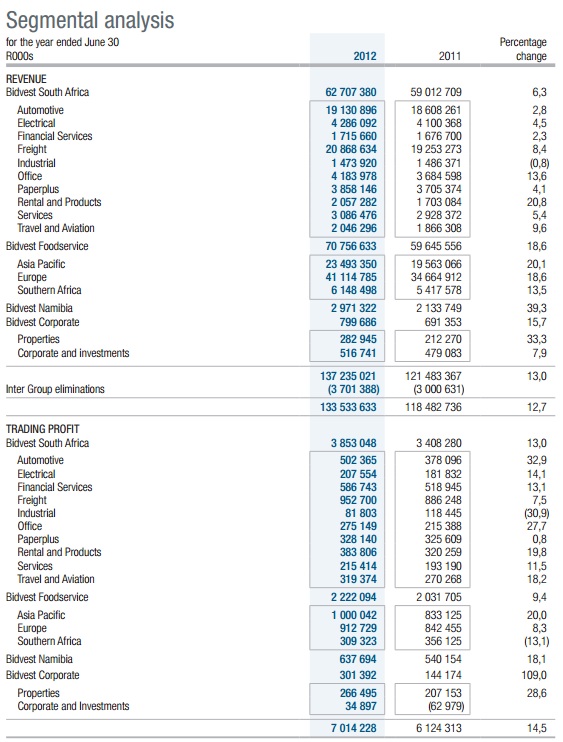

Bidvest have released results for the full year to end June this morning. They look decent enough in this "challenging" environment. The results were pretty much telegraphed in the trading statement, which we wrote up over ten days ago: Bidvest trading update. Here are the numbers that you need to know. Revenue increased 12.7 percent to 133.5 billion Rands, the companies trading profits increased to 7 billion Rands, normalised HEPS clocked 1352.3 ZA cents per share. Perhaps the biggest surprise to the upside is a 29.6 percent increase in the dividend to 622 cents per share. Perhaps this is just to take into consideration the change in dividend taxation. You, the shareholder will get 290.7 cents per share for the second half of the year, 255 cents was paid for the final dividend last year.

To get a real understanding of the business you need to understand all the profitability of the various segments. As we often reflect on, revenue counts for naught if you can't be profitable. So, in trying to determine which are the best businesses that Bidvest owns, there is no better place to look than the segmental analysis. And this you can get for yourself from the The Bidvest Group Limited Audited results for the year ended June 30 2012.

What is immediately visible is that Bidvest Foodservice, the European division is nearly 30 percent of total revenue, but is only actually 13 percent of trading profits. Asia Pacific on the other hand, is just over 17.5 percent of total revenue, but at 14.25 percent of the total trading profits, is the most important profit contributor overall. And of course has the superior margins. My point I guess is simple, if there is a bounce back in the coming year(s) in Europe, then I would presume that is a positive for Bidvest. What always amazes me though is the Bidvest Namibia division. A mere 2.2 percent of total revenues (with an increase of nearly 40 percent) translates to 9 percent of total profits. This is huge and indicates that the margins in the country just to the North West of here are nothing short of spectacular.

What is the attraction of owning this company? It is a valid question of course. Are you owning the genius of Brian Joffe, the current CEO and his deal making expertise? Because over the years he has put together this business, he has been called the Warren Buffett of South Africa. But, unlike Warren Buffett, Joffe does not own the same percentage stake in this business (Bidvest) as Buffett holds in Berkshire Hathaway. He used to own around 23.3 percent economic value in the company, but I think that was before he gave away a whole whack to the Bill and Melinda Gates foundation. And I guess if you want to be nit picking, then you could say that Brian Joffe is a whole lot better paid than Warren Buffett. This company is a steady performer, well diversified and pretty defensive. We continue to accumulate the stock at current levels.