Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

This morning we got full year results from our core recommended retailer, Massmart. To put things into perspective let's just take a quick look at what the share price has done since the Wal-Mart acquisition which took place in June last year at R148. It has had a bumpy ride, but mostly positive all the way up to R180 at the beginning of this year. Since then it has plateaued somewhat trading around R170, where it is today. Clearly investors are waiting patiently for that big Wal-Mart induced growth spurt that the share price is so highly valued for. Let's see if these numbers can give us some direction.

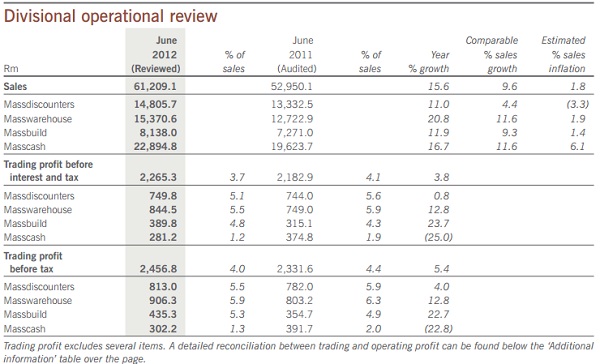

For the 52 week year sales increased 15.6% to R61bn, profits increased 21% and headline earnings increased 38%. That is because last year included the costs of the acquisition. Without those costs headline earnings are only up 8.9%. These headline earnings a share equated to R6.33 affording the company a valuation of 27 times earnings, not too dissimilar to Shoprite, who reported yesterday.

This is however an example of a company who is investing heavily in the future at the expense of current profits. They have financed a record R1.7bn in capital spending on maintenance, growing operations and acquisitions. This is up 20% from last year more directly due to 3 new Makro stores, investment in the Cambridge supply chain and IT upgrades across all divisions. For a company with operating profits of R2.1bn this is big spending. Let's look at the divisional make up of the business and see where the money is made.

In case you weren't aware, Massdiscounters includes Game and DionWired, Masswarehouse is Makro and Fruitspot, Massbuild is the DIY and home improvement brands such as Builderswarehouse and Builders Express and Masscash is the retail cash and carry brands such as Cambridge and Rhino.

It is a great mix, covering all the retail divisions you would expect to grow with an up and coming middleclass and an undersupplied African continent. 8 Game stores, 5 DionWireds, 3 Makros, expanded DC's, acquisition of Fruitspot, 1 Builderswarehouse, 2 Builders Express, 5 new retail cash and carry stores and the acquisition of Rhino which consists of 15 stores were all added this year. This will certainly be earnings enhancing for a company that now compromises 348 stores across 12 countries in sub-Saharan Africa.

Even though the company looks expensive we are not deterred for two reasons. Sacrificing current profits for the future is not a reason to sell, in fact in many cases it is a good thing assuming the demand for your product can match your increase in supply. With the African consumer still off such a low base yet growing we are confident Massmart can infiltrate the right areas. The second reason, and it's one we have discussed before, is the foreign investor premium. Massmart probably have the highest of all the SA retailers because of the Wal-Mart factor. If Wal-Mart back and trust these guys then so will investors. We don't see this premium going away anytime soon so the share price should grow with earnings. We continue to add at these levels.