Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

OK, so we have perhaps one of the most important days today, well at least for us over at Vestact here. No, it is not the fact that we have the sliding doors open celebrating the arrival of spring, but rather the fact that BHP Billiton reported their full year numbers this morning. Byron was so excited he did not sleep last night. No, that is not entirely true, he slept well he told me, but the excitement around the results are of course high here in our office. Market nerds.

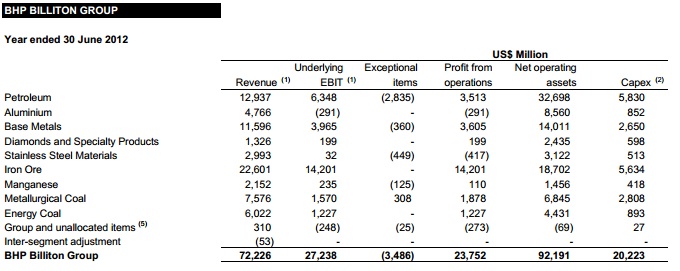

Time to dive straight in, the full release is available for download here Report for the year ended 30 June 2012. Revenue up ever so marginally to 72.226 billion Dollars, net profits off 34.8 percent to 15.417 billion Dollars. Phew, that is a big number, but markedly lower than this time last year, when the number clocked 23.6 billion Dollars. Gearing is now 26 percent, this has not changed that much. Underlying EBIT registered a 14.8 percent fall to 27.238 billion Dollars, profit from operations fell to 23.752 billion Dollars, there were some exceptional items which we deal with below. Here is an operational overview, which I hacked from the results release:

Why the big fall in profits? Well, there were a number of telegraphed write downs, including gas assets bought from Chesapeake, remember we wrote about this on the third of August: BHP Billiton write offs. There was of course also the Nickel West impairment, and a charge taken at Olympic Dam. We will deal with Olympic Dam a little later in more detail, it is important in these numbers. All in all exceptional items nearly topped 2.5 billion Dollars, or 3.7 billion Dollars before tax. It is a whopper. Also impacting on earnings were the weaker commodity markets and rising costs, it is not just a South African issue that. BHP Billiton have dealt with the costs issues by closing several production facilities, two down under and one here in South Africa. Controlling costs is harder when you have fewer operations, that is for sure, when you have smaller ones, such as these ones that have been shut it is easier!

The final dividend is a little higher than last year, now at 57 US cents per share. At the current exchange rate, of around 8.27 to the US Dollar, that translates to around 471 ZA cents for the second half. This follows a dividend payment of 55 US cents, actual payment of 418.96 ZA cents per share at the half year stage. No exchange rate announced for the Rand dividend yet, expect that announcement in around three weeks time. But, if the exchange rate were to remain the same, the Rand payment would be 890 ZA cents for the year. At the closing share price of 257.2 Rands last evening, the company is yielding 3.46 percent. I guess that is more than acceptable for the risk that you assume as a shareholder of the very biggest mining company on the planet. Basic earnings per share after exceptional items showed a 32.5 percent drop to 289.5 US cents per share. Roughly that translates to 2395 ZA cents per share. Again, at a 257.2 ZAR closing price, the company trades on a historic multiple of 10.74 times earnings. That is hardly expensive, but the market has got the share price levels relative to the news flow correct. Well done Mr. Market.

At ten of their operations BHP Billiton achieved record production. We covered their production report when it was released in mid July: BHP Billiton production report for Q4. But here is perhaps the biggest disappointment, but NOT something unexpected, the uncertainty around the development of Olympic Dam continues. Delays. For those of you who do not know what Olympic Dam is, the company has a pretty good explanation: "Olympic Dam is a multi-mineral ore body containing uranium oxide, copper, gold and silver. Olympic Dam is Australia's largest underground mine." Kloppers made a good comment, you will recall that nuclear energy was all the rage and there was much excitement about that, until the Japanese disaster at Fukushima Daiichi. His comment was that the landscape had changed, and therefore the development of Olympic Dam is not going to be what investors had expected. Also, the costs in Australia have risen quite sharply and therefore BHP Billiton are looking at cheaper ways of developing this one of a kind asset. The company therefore says that there is a "change in status" of the project.

So, now that shareholders are expecting lower capex as a result of iffy demand and a less uncertain outlook, how is the company going to allocate capital. "first: invest in high return growth opportunities throughout the economic cycle" And this means projects like the Jansen Potash mine will be prioritised above all else. At the moment. Of course the company invested heavily in the period of the financial crisis, when everyone else was stationary. The company is at pains to point this out, as the differential from their peer group. "second: maintain a solid A credit rating" This means that the level of gearing should be maintained at current levels, and when the company raises money for expansion, they are acutely aware of balance sheet relative strength.

In the presentation the capital allocation continues: "third: grow our progressive dividend" This of course is good news for shareholders, who have been patient. "fourth: return excess capital to shareholders" There were no buybacks in the last financial year, following the whopper in 2011, around 10 billion Dollars. Expect that to happen at some stage in the future, for us South Africans it might not be the most effective way of returning capital to shareholders, but in some other places where the company is listed, most notably Australia, this makes sense. You can't please all of your shareholders when they invest in multiple geographies with different jurisdictions.

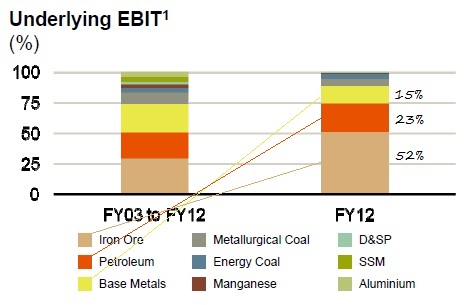

Before I end off, with both their conclusion and our own, I think that it is important to note the earnings mix. It is still for most intents and purposes a three division business. Check out this hacked piece from a slide in their presentation, I have written their underlying EBIT contribution relative to the overall number:

Iron Ore is still the champion, but less so than before. The petroleum division maintains that roughly quarter contribution, which it has consistently done over time. Base metals, as you can no doubt see has been a smaller contributor, but this is not completely due to the lower performance this year, but also in large part due to the outperformance of the iron ore division. The other two major contributors are their coal assets. But this looks like better diversification than their peers, we like the energy aspect.

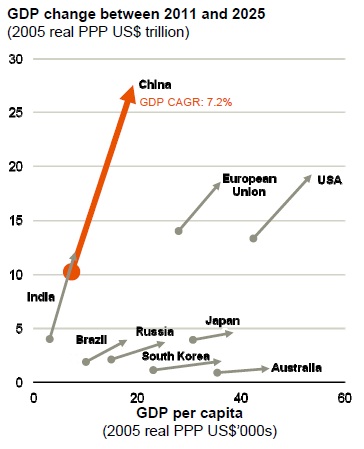

In conclusion as to whether or not you should own the company, I am first going to present BHP Billiton's outlook on Chinese growth.

So whilst Chinese GDP is forecast to be 27 odd trillion Dollars in 13 years time, on a per capita basis, whilst catching their Brazilian and Russian peers, they will still fall short. Infrastructural development is set to continue in China. BHP Billiton in their forecasting provide an eye popping number: "Chinese GDP is forecast to almost triple by CY25 with growth equivalent to 25% of current global GDP". Chinese, broader Asian and much of the developing world urbanisation will continue to buoy commodity prices over the coming half a decade at least. And in a world of choices I want to be invested in the premier mining business on the planet. We continue to add to the position through what we think is cyclical weakness. Buy.