Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

An announcement from BHP Billiton this morning is met with a touch of disappointment, but I guess a sign of the times. They have taken a write down on two assets, one an Australian Nickel asset and the other a recently acquired North American gas asset. And these are not small numbers, they are big numbers. Here is the official announcement US Shale and Australian Nickel Asset Review, and here are the two key lines:

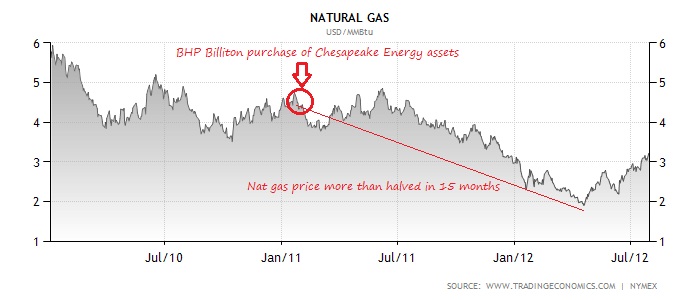

That graph does not really show you the collapse of the price recently, so here is a much shorter graph, where I show you how Nat gas prices were absolutely crushed from the time that they made the acquisition (where there is a circle) and where the price went below 2 Dollars/MMBtu. MMBtu? One million Btu, where a Btu is a British Thermal Unit. Which, as per Wikipedia a "Btu is defined as amount of heat required to raise the temperature of one 1 pound (0.454 kg) of liquid water by 1 oF (0.556 oC) at a constant pressure of one atmosphere.". So this is not that complicated, it is just not really a unit that we are used to, possibly because we do not use that much gas. But here shows you the timing of the acquisition, not very good in the short term:

The reason for the shale gas purchase in the first place is that this was an opportune moment, because the future is good, we will get to that later. But in the meantime, via one of my favourite bloggers, this happened: Natural Gas Spot Prices Now Below $2: Adjusted for Inflation, That's the Lowest Since the Mid-1970s. That is not good. But what is good is that there has been an explosion in the natural gas market in the US, the country is pressing to become energy independent. So much so, that Prof Perry is blogging With Our Abundance of Natural Gas, Let's Export.

I guess that the timing was all wrong, but it could have been a whole lot worse, check out the twenty year price above. In the end I think that these assets will prove to be really good ones. For the meantime, they are struggling. And if you read a little lower down the release you see that both Mike Yeager, who is the CEO of the Petroleum division and Marius Kloppers, Group CEO have decided to forgo their bonus in 2012. Hmm.... that at least is a small comfort to shareholders. This was inline with the market expectations, and the stock has hardly budged this morning. BHP Billiton results will be released on the 22nd of August.