Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Someone pointed something out, at one point in the morning yesterday, the share price of BHP Billiton was more (in Rands) than the share price of Anglo American. So what? Their market caps are vastly different, Anglo is not the giant in the mining space that it once was, and BHP Billiton are the big daddy amongst the mining resource companies. Globally. I often say that we are lucky to have access to a company of such quality.

But what is that about, the two share prices roughly the same? As at close of business, BHP Billiton had closed up just over two percent at 242.90 ZAR, whilst Anglo American added 1.3 percent to end at 246.54 ZAR. I then thought, let us separate the currency translation, and because Google Finance deals with the majors, it is easier to compare the two. So let us start with a five year view of the two entities. BHP Billiton is up 38 percent, whilst Anglo American is down nearly 30 percent. Over ten years Anglo American is up 101 percent (these are all prices in London, the currency translation is irrelevant here, I am guessing for the purposes of this exercise), whilst the BHP Billiton is up an astonishing 548 percent. Over the last year things are not so pretty, Anglo is down nearly 34 percent and BHP Billiton are off an equally yucky, but less noticeable 17.3 percent. Less noticeable in the current environment, because the currency has buoyed our price locally, over one year the GBP has strengthened by nearly 17 percent to the ZAR. So I guess it should come as no surprise that BHP Billiton in Rands is off three percent over the last year, and Anglo American is down nearly 23 percent. Ouch. That has to hurt.

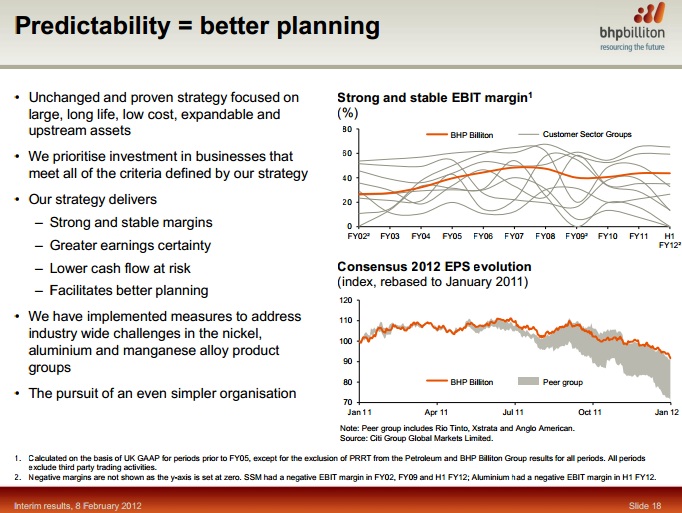

What has the market told you however? In my view it all goes back to the graphs on slide 18 of the presentation Interim results - Half year ended 31 December 2011. I have incorporated it here in this newsletter for you to see.

Look at the slide carefully, first the top graph shows you that the margins are more stable than their peer group, which are Rio Tinto, Anglo American and Xstrata, the only noticeable missing major is Vale. But that is the point that I am trying to make, BHP Billiton has the least volatile earnings of the lot. And we like the energy cluster. Anglo on the other hand continue to have issues in their platinum business, regarding costs, but then again, everyone has that in South Africa. I think in the end it does come down to the quality of your portfolio, and for the time being BHP Billiton has that well sewn up. For longer dated commodity holdings we continue to prefer BHP Billiton.