Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

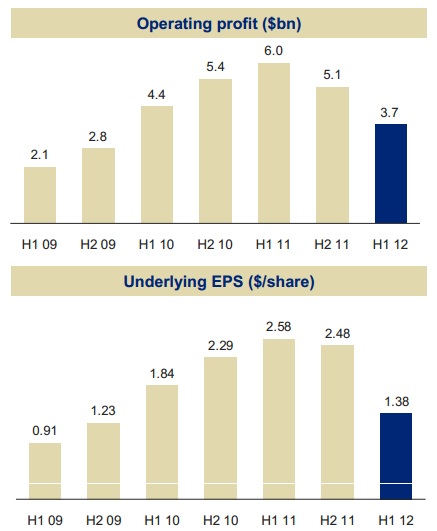

Anglo American have released their interim results this morning, and it looks like an earnings miss, the stock has sold off in a market that is moderately higher at the get go. I saw a brief interview with Cynthia Carroll on CNBC this morning, she was getting excited about controlling costs. But the facts are, as per the release, HALF YEAR FINANCIAL REPORT for the six months ended 30 June 2012: "Anglo American reported an operating profit of $3.7 billion, a 38% decrease. EBITDA decreased by 31% to $4.9 billion and underlying earnings decreased by 46% to $1.7 billion." Of course, because Anglo American has all the listed parts, we get to see quite a few of them over the last couple of weeks, before the actual number. And in fact, the biggest surprise for me (other than the delays at Minas-Rio and miss in earnings) is that Anglo have UPPED their stake in Kumba Iron Ore by 4.5 percent to 69.7 percent!

Anglo has a very well known portfolio, but this newsletter is intended for a very broad audience, so we need to tell you what the company does. You might well say, oh, it is a diversified miner, but in our world, a diversified miner is not just a diversified miner. Your underlying portfolio can look very different from your market peers. As per Anglo's website, the "portfolio of mining businesses spans bulk commodities - iron ore and manganese, metallurgical coal and thermal coal; base metals - copper and nickel; and precious metals and minerals - in which it is a global leader in both platinum and diamonds." There are some of those bulk commodities that we like a lot, iron ore, coal and copper, but diamonds not so much and "things" look a little tougher for the platinum industry than five years ago. A whole lot tougher, read David McKay's article in MiningMx: SA platinum sweats amid cash-flow crunch. We like the energy part of the business that is in BHP Billiton, you know that already, we have been buyers of that one over Anglo for the better part of half a decade.

The parting outlook, which we will deal with now, almost confirms what a lot of people have been starting to say, that the current quarter perhaps represents a bottoming of sorts. I think that it needs a copy paste in whole: "The short term outlook for the world economy has deteriorated in recent months. The Eurozone crisis has intensified, adding to economic uncertainty both inside and outside the euro zone. After a promising start to the year, the US economy has weakened in response to greater fiscal uncertainty. The major emerging economies - notably China, India and Brazil - have also slowed. Significant policy easing, however, should underpin a recovery."

Well, that does sound somewhat reasonable, but the question remains, if you are to buy this business today, at the current share price of around 250 Rands a share, what are you getting? Forget the past. The current share price represents the outlook and prospects. We might not all agree that the rapid urbanisation in emerging markets is an enduring theme, that is set to continue to dominate over the next decade, or more, but that is still our base case. I have no doubt that lower middle class people want to work their way up the chain of wealth, work harder, have access to more "things" and improve the lives of the next generation. In his own dry way Milton Friedman wondered why that was, parents creating a much better life for their children whilst compromising their own, cost savings and the like. But that is the human element that economics tries to understand, the behaviour of the current generation and the repercussions for their offspring.

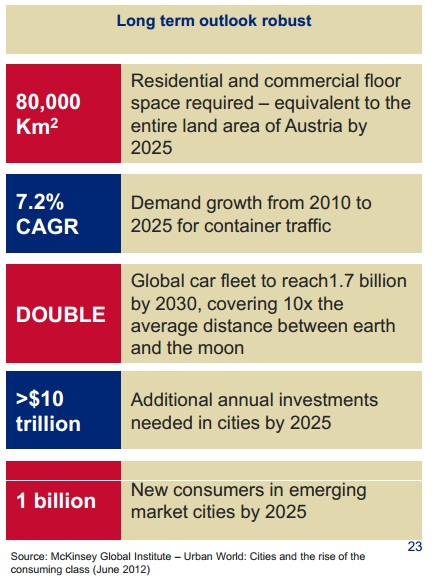

Anglo has a nice slide that shows all that still needs to be done. According to McKinsey, that is. That would mean a lot of resources would still be required and as such, Anglo and many others in the sector, BHP Billiton, Rio Tinto, Xstrata and Glencore would all be in the sweet spot. I left Vale out, that wasn't nice.

But in the end it all comes down to valuations. If you wanted to know why the stocks in the resource space were starting to look so cheap, then look no further than this slide in their presentation:

So that is why the stock and the sector looks cheaper before today, the earnings just had to catch up. Cheap yesterday, today, well not so much and often cheap for a reason. Bill Miller, the iconic Legg Mason fund manager avoided the sector, because the earnings were not reliable enough. The only positive that I can take away from these results is that the dividend has been upped to 32 US cents, from 28 cents last time. And the Kumba purchase, adding to that position. In the end it does depend on whether you think that this time is different or not. Are we in the middle of a commodities super cycle, rather than a commodities boom? I believe the answer to that is yes. But whether or not Anglo can execute properly, well, we answer that question for our clients by buying them what we think is the superior of the two (or more) choices in our market, BHP Billiton.