Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

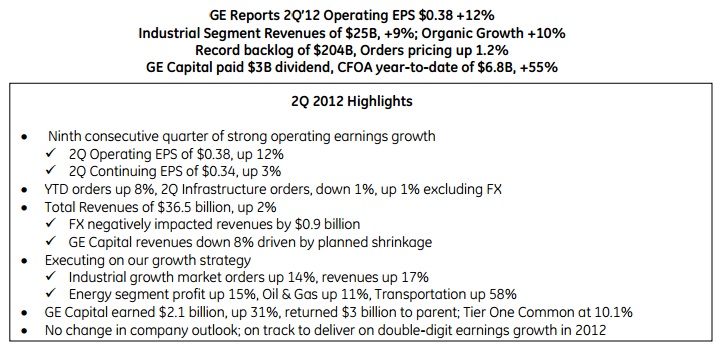

It is difficult to figure out when the company was actually founded, but the General Electric timeline on Wiki suggests 1890. In 120 years the business has become perhaps one of the most iconic company names on the planet. These were results for the second quarter of 2012, and the media release is available here: GE Reports 2Q'12 Operating EPS $0.38 +12%. The heading is actually a great summary of how the business is looking:

If you look at the presentation, which is always a wealth of information, GE 2012 second quarter performance, scroll to slide number 3, which shows the massive backlog, which is now 204 billion Dollars. So, what does a backlog tell you? Well for one, notwithstanding all the flopping and falling around in Europe, the GE order book is the strongest ever. I guess that could change at any one given time, but it is what it is. Strong. Meaning that whilst we are anxious, or seemingly anxious, business is pushing ahead with new orders.

Whilst we like GE a lot as one of the starting points when building a diversified portfolio, the questions will always remain, is GE finance going to return to anything like it was half a decade ago? Perhaps not immediately, and that is not the reason that we own the business. We like the energy, oil and gas, healthcare and transportation parts of the business, not so much the real estate assets. But GE Capital represents over 30 percent of sales and as much in profits. And the success of these quarterly numbers could largely be attributed to GE Capital, the Industrial part of the business owed all of their headway to energy infrastructure. Expect that specific division of GE Industrials to continue to grow as America seeks internal energy solutions and less reliance on external oil supplies. Good for the Dollar, good for the US, not so good really for the Middle East. We continue to buy the stock at these levels, looking for a greater unlock of value in a business division split. Perhaps it won't happen immediately, or even in half a decade, but in the interim you own perhaps one of the bluest of blue chips anywhere in the world. And for the time being, the strategy over at GE is to make GE Capital smaller. I can think of a way to do that immediately!