Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

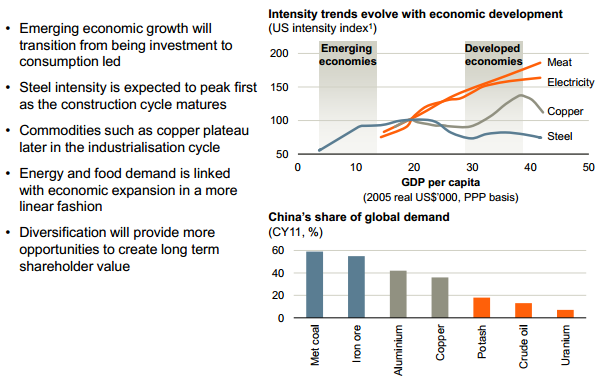

BHP Billiton has released a presentation about their base metals business this morning, it always makes for interesting "looking" and reading -> Building momentum in Base Metals. There are always a couple of slides that catch your attention, this one in particular is a goodie, what it shows is resource usage in countries as their GDP per capita rises and they head towards developed country status. The slide is titled: Demand evolves with economic development

The point that the base metals division is trying to make is that they are more likely to be in the sweet spot later, with oil, uranium and in particular potash going to be more important as China evolves towards developed status. The example often used is close neighbour South Korea, who transitioned from developing to developed status over the last 60 years. I was interested in their copper assets part of their presentation, but it is nothing new. What I was particularly interested towards the end of the presentation was the Chile slide about costs and labour. Sounds very familiar, check out the key points on labour:

When BHP Billiton say other jurisdictions here, they are referring to their other base metals projects. But then they say something about costs, which makes you sit up and take notice:

So what that means is that if commodity prices stay here, then at least they have the best quality assets. But that is always what Marius Kloppers says in his Nataniel type voice, about the BHP Billiton assets being Tier one. I do a decent impersonation of Marius and perhaps Nataniel as well. Comfortable? Yes, we are using the lower prices to continue to add.