Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Tiger Brands have released results this morning for the six months to end March. This is a business that has brands entrenched in your pantry for over generations, All Gold tomato sauce is a big hit in my house, Black Cat peanut butter is great as long as you are not allergic to the thing, Colman's mustard is my pops favourite, Fatti's & Moni's I don't buy anymore, I make my own pasta (no really), Koo is baked beans, Beacon sweets, Maynards chewy sweets are always a favourite, Ace maize meal a huge staple in South Africa, Albany bread, I use the sliced kind, Golden Cloud, I use it sometimes, Jungle oats, I should eat more of that, Tastic rice, I like it a lot, more recently Energade, which I used to drink when I ran more (I should, lazy bum me), old favourite Lucky Star, not my favourite, the baby products, Elizabeth Arden and Purity which I don't use anymore, my babies are not babies anymore. Putting a feel to the stock, something we do not do enough of.

Group turnover for the period clocked 11.6 billion Rand, an increase of just over 12 percent from H1 2011. Domestic turnover, that is you and I buying jam and peanut butter, increased only 3.4 percent, but exports and their international businesses grew turnover by 27 percent. This is largely what people have been getting excited about is my guess, bidding the stock higher. Their expansion plans into the rest of the continent, we sometimes think of ourselves as not part of Africa. Hello, Africa is the second part of our name. OK, getting distracted here again, profits increased 10.1 percent to 1.295 billion Rand. Headline earnings per share increased a paltry 5.2 percent to 787 cents per share. The interim dividend is 5 percent higher to 295 cents per share, BUT, after the 15 percent dividend tax, the dividend received by the shareholder (most) is closer to 250 cents per share.

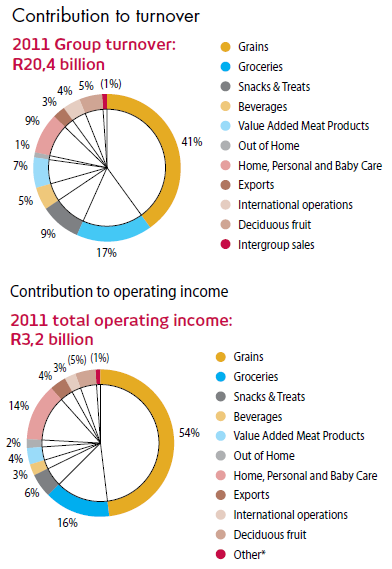

What is interesting about Tiger Brands is to know what you are dealing with, so I hacked the annual report and came up with this turnover and contribution to operating income, and you can very quickly see that it is about boring old grains. Tastic, Albany, Ace and Tiger Oats are the most profitable parts of their business. Strange to think that, but it is true. Check it out:

The last two years have been quite exciting for Tiger Brands, they certainly have expanded into the rest of the continent, sub Saharan Africa mostly. We are actually seeing interesting talks between Tiger and Dangote Industries with regards to the Dangote Flour Mills. It seems either Tiger want to buy the Industries stake from Flour Mills. Aliko Dangote is the richest fellow in Africa, according to Wikipedia he is worth over 11 billion Dollars. Dangote flour is a major producer of much of Nigeria's wheat flour, bread flour, confectionary flour and pasta semolina. Of course Tiger has bought other businesses in Nigeria, UAC Foods which is in the confectionary and drinks business as well as Deli Foods, a biscuit manufacturer. There is of course another West African business in Cameroon, Chococam, a small cocoa product business. Small as in, when Tiger bought it back in 2008, annual turnover was a mere 28 million Euros a year. Across the continent and in Kenya, Tiger have a business called Haco Industries, a much more sizeable entity selling the products we know here, as well as other products in the personal care segment.

This business is run by Peter Matlare, a fellow who once ran the hot potato SABC for a whole four years. He resigned from that role back in 2005. Peter Matlare then went to Vodacom, where he was chief strategy and business development officer. Matlare has been running Tiger Brands for over four years now, he certainly had big boots to fill in the form of Nick Dennis. Dennis fell on his sword as a result of the bread price fixing scandal which cost Tiger nearly 100 million Rand. The CFO is a relatively new appointment, from last year June, Funke Ighodaro. She is educated in the United Kingdom, worked for Primedia as well as for Kagiso's private equity fund. So it seems like she has done the time, she is older than I thought (good picture!) and seems more than capable. Talking management shuffles, the Chairman, Lex van Vught, resigned on Valentines day and Andre Parker took over. Parker is also relatively new to Tiger, having sat on the board since 2007.

We know the size and scale of the business, we know their history, we know that they have been one of the single best investments in South African corporate history. They really have, they have unbundled amongst others, Adcock, Astral Foods and Spar along the way. But at 266 Rands, is the stock priced too aggressively? It is a September year end and judging by analyst consensus it is trading on a forward multiple of 15 times and a dividend yield forward of a modest 3.3 percent. Their expansion plans are exciting, that is why I think that you are forced to pay up to these levels. Earnings are expected to grow around 14 percent per annum for the next couple of years, and the yield should also tick up accordingly, we remain buyers of the stock in our extended portfolios.