Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

African Bank have released results for the six months to end March 2012 this morning, as previously indicated to us. Remember a few weeks ago, we wrote up about the steer that the company gave us,African Bank trading update comes inline with expectations. We suggested that the middle of the range was 170 cents, and bang this morning we saw earnings per share clock 170.4 cents. The dividend was unchanged at 85 cents for the first half, at the top end of the dividend policy this is two times cover, perhaps not so much as in the past, but the commentary gives the following reasons: "We believe that the current cover will retain sufficient capital to support growth for the current year." AND "The group will continue to manage its dividend policy to support ABIL through the current growth phase as well as the anticipated Basel III impacts." But still, if you double the first half earnings (which you shouldn't, it is the better half) the stock trades at around 11 times forward earnings and a dividend yield (presuming unchanged for the year) of just over five percent. 5.2 percent. Sounds good to me.

OK, headline earnings increased 25 percent to 1.37 billion Rands, almost all of it from the banking unit, the furniture unit is slowly turning around. But, making progress of course. The return on equity has moved north for the last few years, to poke its head up back over 20 percent. Return on shareholders equity is defined as follows from Investopedia: "The amount of net income returned as a percentage of shareholders equity. Return on equity measures a corporation's profitability by revealing how much profit a company generates with the money shareholders have invested. ROE is expressed as a percentage and calculated as:

Return on Equity = Net Income/Shareholder's Equity

Net income is for the full fiscal year (before dividends paid to common stock holders but after dividends to preferred stock.) Shareholder's equity does not include preferred shares. Also known as "return on net worth" (RONW)." So, rising return on equity is a good thing.

Customers added for the period clocked 320 thousand and more importantly, dormant customers reactivated or rehabilitated numbered 133 thousand. Nice. This is important, listen in, 54 percent of new customers walk away with credit cards being issued. So, I guess the new customers can go and pay for school fees or additions to their new house, you will see later. AND, there are pilot programs for both funeral insurance as well as a vehicle financing division, which has extended 94 million Rand thus far.

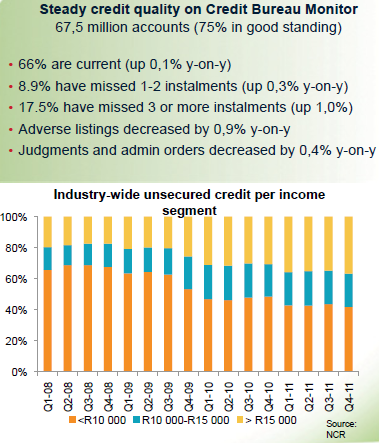

A great slide from the presentation, titled "Unsecured lending growth", you can find it here: African Bank Unaudited interim results. The graphic below is hacked just to give you an idea of who has accounts in South Africa, and how most people make sure that they look after their credit records.

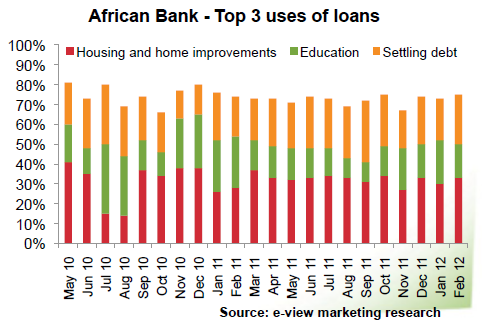

And then there is another slide, which ABIL suggests how their customers use the loans advanced. I reckon it is deserving of another slide to have a look. Most of the loans are taken for improving homes and improving lives by paying for education. I guess two things that you cannot take away in a hurry and improving the country. You might not like me saying it, but credit extension, provided that it is serviced properly improves peoples lives.

Nice. We were saying, OK, the total book is 47 billion Rand and is roughly one tenth of the size of ABSA's total book, but as Paul pointed out, ABSA has had a century and a half to build their book. ABIL was founded in 1974, but has only exploded in the last decade or so. In truth ABIL have only been a listed entity since 1998, when Theta acquired King Finance, Unity Finance and AltFin. The name change to the current one came in 1999.

That is all history. I do not care too much for the past, history was a favourite subject but I guess is only useful if you are in a profession that needs it. Think law. African Bank is a growth business and the rating that they are trading on is inline with some of the bigger more established banks, who are having problems of their own. We think they should trade on a higher multiple, but that will come in time. We have a great admiration and respect for the management team, and think that they are always in deal making mode. We suspect that a growing middle class in South Africa will continue to grow their credit profiles as they try and get ahead. We continue to maintain our buy rating on the stock.