Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Another tough set of results for Investec. Adjusted earnings decreased by 21.4% for the year ended 31 March 2012. To put things into perspective the Investec PLC share price is down over 4% so far this year while the overall banking index is up over 16%, even after this recent fall. Wow that is a big underperformance. It seems like their exposure to boring old developed economies is slowing them down. The UK and especially Australia have really dampened earnings while South Africa is still doing fine.

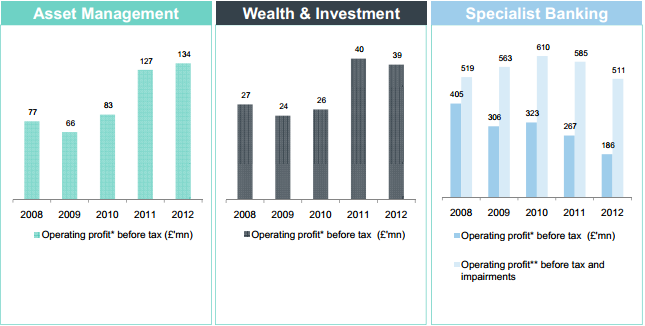

In terms of their segmental performances the asset management and wealth management businesses now contribute 48% of the groups operating profit. That is up from 38.6% last year. They will be happy with this because that has been the long term plan for a while now, shifting away from capital intensive activities to higher margin asset management.

It was the specialist banking segment (which is responsible for 52% of profits) that let the group down with operating profits decreasing by 30.2%. Again the South African division did fine. "In South Africa the division has benefited from improved margins in the lending and fixed income businesses and a strong increase in fees and commissions supported by increased activity in the corporate and advisory divisions." That is nice to see for our economies sake. The UK was mixed but Australia got hit hard by big property impairments while activity levels remained muted.

To get a good feeling of the operational mix and how they have preformed over the last few years I hacked this graphic from their results.

I guess in a world of choices why would you invest in a bank that has exposure to struggling economies when there are better options out there. The growth is coming from the developing world so allocate your money there. Another worrying factor which we tend to ramble on about was thrown in our faces again with the latest JP Morgan trading saga. These guys were supposed to be the best operators amongst all the banks and $2bn (possibly more) still managed to slip through the cracks. It is an unwanted risk and regulation is only going to get stricter.

There is no doubt the company offers some value and there is a good chance the stock will turn. The stock trades on a 13 times historical valuation but analysts expect a big jump in 2013 earnings after all these impairments have been absorbed. However we prefer to stay away, not because of the company or its management (who do happen to pay themselves very well), but because we avoid the whole sector. You see we are not bullish on everything, this market is about making your choices very wisely.