Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Yesterday Sasha covered the BHP Billiton report which was titled "Technology, strategy and the growth of gas as a source of global energy." I want to touch on it again because as investors in this company it is an extremely important growth story that Billiton are investing billions of dollars in. Billions of dollars which may have been ill timed.

In fact there are rumours that they may have to write down the $17bn investment they made in both the Fayetteville and Petrohawk shale gas assets they bought last year. Why? Because, the price for shale gas has halved since this acquisition. It was unfortunate timing as a warmer than expected winter hampered demand while an improvement in technology flooded the market with supply. I would say this is one of the large factors that have hampered the Billiton price this year.

A write down will not be ideal and in the report Billiton state that they are actually holding back on gas production because the price is so low. But what may be a negative in the short term could be a big positive for the long term. Because the price is so low, gas is becoming more and more attractive as an alternative source of energy. This means that more technologies are going to be developed which is geared towards gas consumption. This will include mass consumption industries such as transport and electricity generation. Not only does it produce 1/3 of carbon that oil does but it is also in abundance in the US which will play very well into the US governments strive for independence from the volatile Middle Eastern oil producing nations.

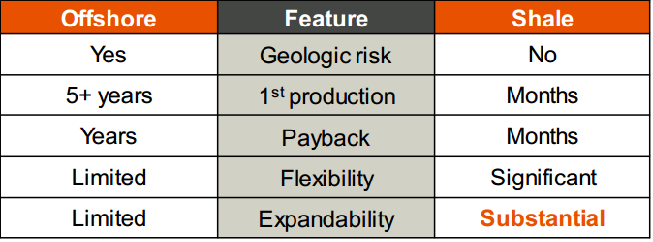

All the fundamentals are there for an increase in energy consumption globally and as the world embraces gas more than it already has, Billiton will be ideally placed to benefit. And when this happens it will happen quickly. As you can see from the graphic below which I took from the presentation, mining gas is easy, sustainable and profitable.

Yes, supply will keep the price low in the short term and the technology will only improve but as a long term play this industry is going to be massive in a country that is ideal to operate in and extremely willing to embrace alternate sources of energy. In Fact Citigroup said that the gas industry in the US could be the catalyst to the next industrial revolution which will solve all their budget issues. Why not? And mankind as a whole will benefit from cheaper cleaner energy.