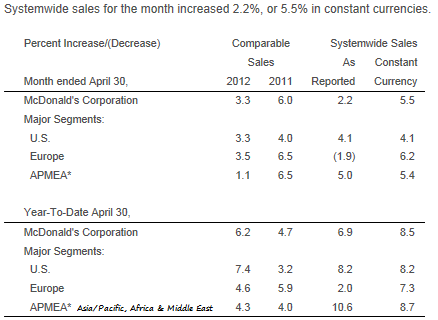

McDonald's released same store sales that really flunked, they were not bad, but for Mr. Market all he/she wants to see is that it beats expectations. And this it did not. We wondered for a little bit whether or not the stories about people starting to "eat up" in value was partly to blame for these numbers coming in with a weaker showing. Here is a quick screen grab from their press release -> McDonald's Global Comparable Sales Rise 3.3% In April.

I think that whilst analysts may have underestimated the impact of the stronger US Dollar on these sales, the constant currency sales number was quite important when trying to develop a trend view of how their sales are panning out. Looks just fine to me, but the equity participants voted with their feet, sending McDonald's over two percent lower to 93.55 Dollars. I like these prices, this is the same price as you are getting in November last year. The stock forward with estimates of 6.30 Dollars worth of earnings for the next fiscal year is trading at less than 15 times earnings. Which is a whole lot cheaper than Famous Brands, see Byron's piece from two days ago: Famous Brands trading update, still looking good. And let me be clear, I would rather own McDonald's AND Famous Brands, but if faced with only the choice of one, I would side with McDonald's. After all, McDonald's has increased their dividend EVERY year since implementing one for the first time back in 1976. Healthy sign, which is ironically the direction that their food is moving.