Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

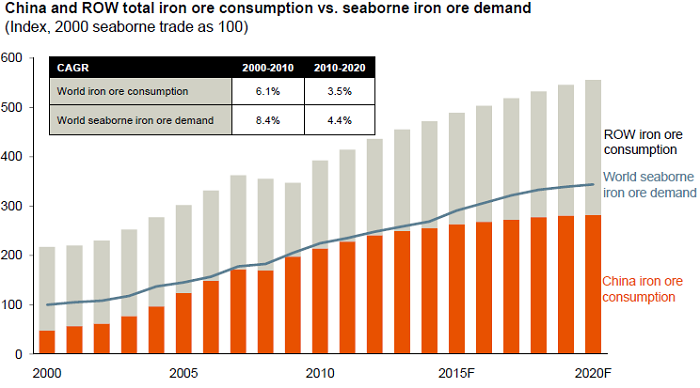

This is very important, pay attention. This morning the fellows from BHP Billiton said that they thought that Chinese iron ore demand would drop to single digit growth, if it is not there already. This is as the Chinese economy continues to slow. Oh dear I hear you say, but wait, because in addition to their current consumption, expectations are that Chinese iron ore consumption will grow at 100 million tons per annum for the next eight years. And in addition to that 600 million more tons to satisfy growth expectations, as well as replacing around 200 million tons of current supply. So that sounds like over one and a half billion tons of iron ore needed in excess to the current supply. Wow. Just to put it into perspective, the chamber of mines website told a friend who told me that more steel is poured in one hour than all the gold ever poured. I am pretty sure that if you did the math you would come to the conclusion that perhaps gold ought to be priced higher, simply because of the rarity.

BHP continued to say that they expect their annual run rate to top the forecast 159 million tons, and to be closer to 165 to 170 million tons. Nice. They also expect a floor on iron ore prices of around 120 dollars per ton. Since November the spot price for iron ore has nearly clocked 150 dollars per ton, and traded as low as 130 dollars per ton. Back in August last year however the price traded at around 177 Dollars per ton, so we have seen a slide since then. So, the share prices of all the iron ore producers have taken a knock, but I think the bigger picture still remains intact. China will continue to grow, but not at the same pace as in the past. All this talk is interestingly taking place at the AJM Global Iron Ore & Steel Forecast Conference in Perth, Australia. The presentation, given by Iron Ore group President, Ian Ashby is available here -> BHP Billiton Iron Ore - Growth and Outlook.

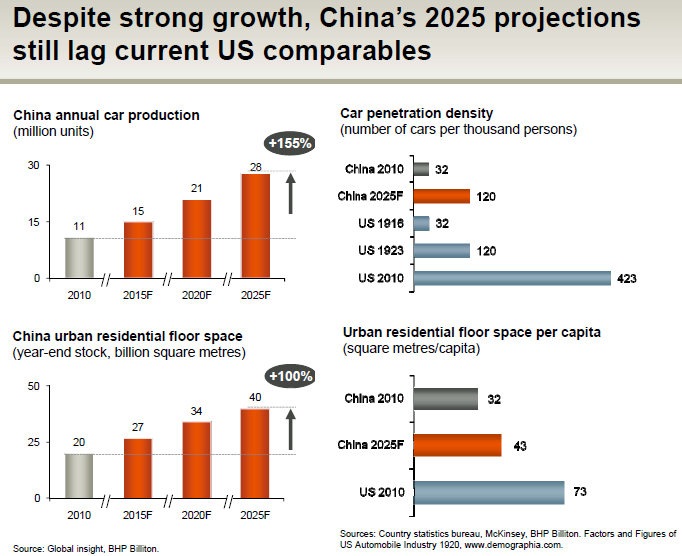

The line about the long term outlook is what I am interested in: "Structural drivers of industrialisation and urbanisation in the developing world remain intact." This chart is eye popping, it compares the US at various junctures with where the Chinese are now. It measures motor vehicle density in the US in 1916, during the first world war, and suggests that in China 2010, the density is the same. Let me get that right, the number of vehicles to population in the USA in 1916 is roughly the same as it is in China now. Wow.

Wow. This next slide however is the one that you have to see, before you get too anxious about all the headlines on the Iron Ore market that you no doubt are going to see today. The next graph is the one you have to see.

Errrr.... slowdown? Where do you see a hard landing? Not really. But I guess it is what it is.