Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

McDonald's released same store sales for the month of February yesterday before the market opened -> McDonald's February Global Comparable Sales Rise 7.5%. They managed to beat in the US, but fell short in Europe and that impacted on the overall number. And Mr. Market focused on that point, the miss on the headline number, the stock sold off heavily on a day (down nearly three and a half percent at the worst point) that the rest of the market was enjoying gains. Europe accounts for around 40 percent of all McDonald's sales, and the sales number was 4 percent versus the 6.6 percent expected.

In the US, their original market, same store sales for the February month clocked 11 percent in gains, "supported by strong customer demand for Chicken McBites, classic core favorites including Filet-O-Fish, signature beverage offerings, and McDonald's breakfast line-up.". Holy cow! The estimates were for 8.6 percent growth in their home market. People forget though. In August last year, group same store sales was 3.5 percent. Versus 7.5 percent now. That was six months ago. US sales were 3.9 percent, they now top 11 percent. Even the European sales in August showed 2.7 percent growth, that number now is 4 percent. Disappointed? I always argue that if a stock price drops and the company is a quality one that somebody wants, then buy some more!

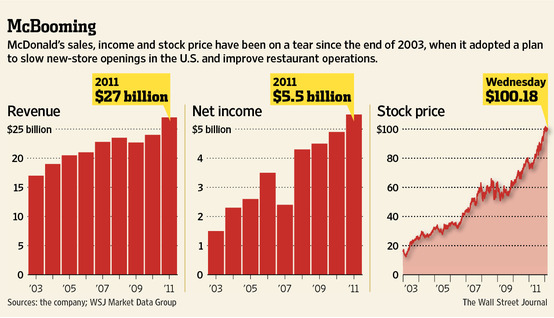

What is this chart? Paul sent this to me last evening via the WSJ News Graphics twitter feed. Which you must follow. Not just sales at all costs you see, the plan back then, when McDonald's management took a long hard look at their business was to be able to grow the business off the existing base. And that they most certainly have done. Do you know what I like most about the business? The fact that every year since the company started paying dividends 36 years ago, they have managed to increase it. Every single year. Take a look -> Cash Dividend History.

The business and most importantly product is simple to understand and is completely reliable, no matter where you are in the world. The menu might have tweaks around the world, this is the one that you will be familiar with: Full Menu Explorer. That is just the half of it, around the world you can get for instance a Pasta soup with sausage for breakfast in Hong Kong. Or in India a Paneer burger. In Thailand you can get fried chicken wings. No really. For Ramadan the menu gets a shakeup.

I have heard this a lot, people worried about the menu and the official hard line from governments around the world with regards to various fat taxes on their products. But as Paul pointed out to me yesterday, in an interesting WSJ article (I said this was some of the best stuff I had read in a while) titled 'Super Size Me' Generation Takes Over at McDonald's, the company will change.

It is an amazing article of how in the US, around 30 percent of the franchise owners are kids of former franchise owners, and come with their new ideas. But it is not as easy as just walking in, getting the keys and waving bye to your mom and dad. McDonald's has to approve them (the kids) first, and the process takes around one to five years for the company to give the thumbs up to the new owners. The point Paul was trying to get across to me however, from this article is that if people want organic beef patties, or gluten free buns, then McDonald's will have those menu items in time. They are not chasing the gourmet burger market, BUT, will supply the correct items to comply with what their customers needs. Exactly. In fact the graphic above comes from this article.

Back to the same store sales, the matter at hand. The short term outlook is about the same as everybody else: "As previously communicated, while McDonald's continues to deliver global top-line sales results, the current operating environment includes persistent economic uncertainty, austerity measures in Europe and commodity and labor cost pressures, particularly in the U.S. These challenges are expected to impact the Company's first quarter operating income growth." And that is fine. Their end plan is to have a store in every neighbourhood. And let us just say that we are an age away from that, we continue to accumulate the stock.