Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

This morning we had 6 month results for the period ending 31 December come out from First Rand. Fortunately they make things a lot less complicated following all the unbundles of those insurance assets. The business is less complicated. Here is what the results compromise.

"The Group consists of a portfolio of leading financial services franchises; these are First National Bank (FNB), the retail and commercial bank, Rand Merchant Bank (RMB), the investment bank, and WesBank, the instalment finance business. The primary results and accompanying commentary are presented on a continuing normalised basis as the Group believes this most accurately reflects its economic performance. The continuing normalised operations specifically exclude the profit on unbundling of Momentum, the earnings contribution of Momentum and the profit on disposal of OUTsurance."

That makes my life a lot easier. Let's look at the highlights. If you are up to date with the social media world and pay attention to various marketing ploys you will be well aware that FNB have been on a massive drive to innovate and gain market share. They were the first out with a smartphone application which is very useful and they have made opening up an account very quick and easy. You'd have to say this has worked. Normalised earnings were up 26% to R5.7bn. This equated to 102c per share with a dividend 44c being paid. The share trades at 2429c and if you annualise these numbers we get a forward multiple of 11.9 and a dividend yield of 3.6%.

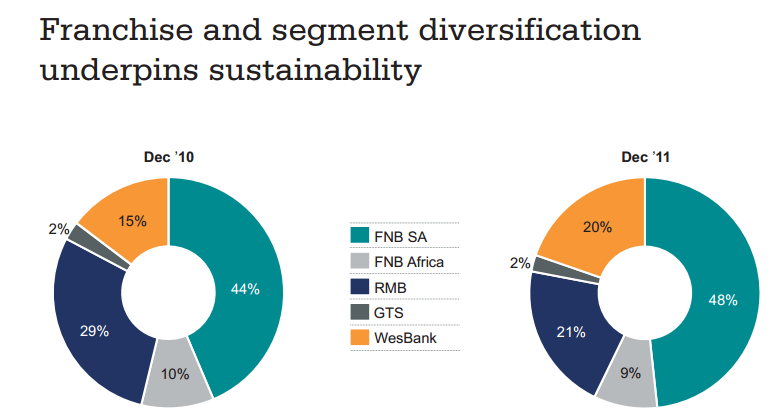

When you look at a bank like this I think it is very important to look at each division separately. Here is the segment diversification thanks to their results presentation. I think it's a good revenue mix.

Interestingly the earnings growth came from FNB and Wesbank whilst RMB actually experienced a 14% decline. "The increase in earnings was delivered through very strong operational performances from FNB and WesBank, driven by loan and customer deposit growth, new customer acquisition, expanding lending margins and robust transactional volumes."

The FNB division grew earnings by 31% and compromise 58% of overall earnings. This was due to a 5% increase in customers and a 10% increase in transactions. A lot of emphasis is being put on customer growth and less expensive electronic channels. Thank you technology. This is the part of the business I like. There is a lot of potential in the under banked Africa and there is a very competitive race to grasp the up and coming South African middle class.

Wesbank has also done well. We spoke about this last week when we looked at Imperials results. Car sales are blasting expectations and I expect them to carry on doing this. They have also started focusing on unsecured loans which has improved earnings and margins. We obviously like this strategy through our African Bank recommendation.

Like I mentioned earlier, RMB earnings declined by 14% due to weak macro conditions. We are well aware that equities and commodities did not have the best of times in the second half of last year and this is what the decline is attributable to. RMB has a great reputation and is a well run business. I just don't like the sector. Too much regulation and too cyclical.

It's a good business with exciting prospects being a well managed bank in a developing market. There are better options out there for us however. We prefer African Bank who remain focused on a market First Rand are trying to grasp. There are still too many moving parts and the investment banking division is not something I would be keen to invest in.