Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Massmart released their 26 week results to Christmas day 2011 this morning. Sales increased by 15 percent to 31.492 billion ZAR, headline earnings increased by 21.1 percent to 895 million ZAR, with headline EPS at 416 cents per share. Thanks to a weaker currency: "The weaker Rand during the period boosted foreign exchange translation gains and we began incurring costs related to the integration of Massmart into Walmart. Excluding these two items, operating profit would have increased by 4.8% and headline earnings by 8.7%."

The dividend was unchanged at 252 cents, payable on my birthday. You have to figure that out, when you get the payment in your account, remember that it is my birthday, OK? Cash generated from their operations was up a whopping 60 percent plus to 3.58 billion ZAR. Costs are a problem for everyone, up 14.4 percent "as a result of our investments in: refurbished and new stores (space growth of 6.0%); supply chain facilities and capability; and Food Retail; as well as above-inflation increases in local taxes and service costs."

There are some interesting observations about the state of the consumer: "The trends in the health of the consumer appear to be improving, underpinned by real wage increases and improving employment, but dampened by signs of over-indebtedness within the middle-income consumer." I suspect this is about the best description that we have seen on the state on the consumer thus far, a little bit less cautious.

But then there are other interesting observations about the regulatory environment, the business landscape in South Africa. "The increasing complexity of the regulatory environment has required an investment in compliance. Given the high costs of compliance, these trends have inadvertently made it more difficult for smaller retailers and suppliers to compete." See, non revenue generating jobs in compliance, something that regulators think is important, but in my world it does strangle efficiency. I understand that you need to make sure you do business right, by the rules, but it should be taken in the context of the high unemployment rate in South Africa.

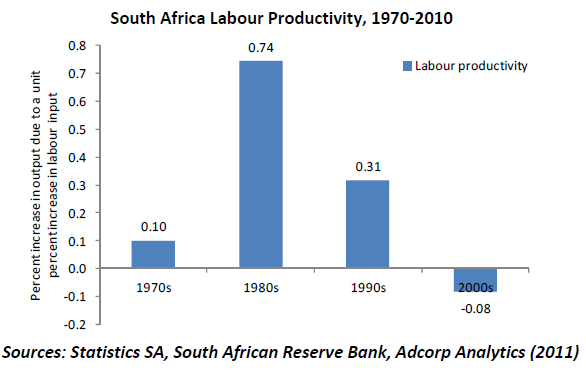

Massmart continues: "The underlying cost pressures in services, electricity and transport require a greater investment in productivity gains. This, at the same time as the proposed onerous labour legislation, will put a strain on employment levels and labour relations." For a second, forget all the opposition to the Massmart slash WalMart deal, because it would force some retailers out of the market. As Massmart point out, the tight labour regulations are enough of a burden on the economy and not allowing job creation. And as the Reserve Bank has told us, productivity is much lower than it has been in years gone by. If I remember the graph well:

And no doubt "things" are not improving from a productivity point of view, otherwise Massmart would not have made these noises. Business is getting a little more vocal about these issues as obstructions to easing unemployment. OK, these discussions aside, because in reality, they solve very little and sound more like a bicker fest.

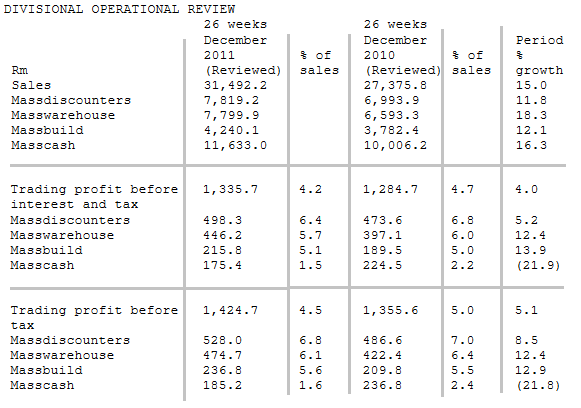

Divisionally a picture tells a thousand words:

The underperformance (and glaring against the other divisions) of Masscash was described as follows: "Despite a good sales performance, trading profit declined as a result of our investments in growth, price and capacity as we build the Cambridge and Saverite brands and supply chains." But on balance, nice to see from all of the divisions, and a ramp up in the food division.

So my conclusion here is that the stock looks stretched, in exactly the same way that Shoprite does. But we prefer the diversity of Massmart. We like the management team too, you might well say that they are overpaid, perhaps the WalMart culture might see them reign that in. But, you get what you pay for in life. And you cannot doubt the quality and ability of the team.