Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

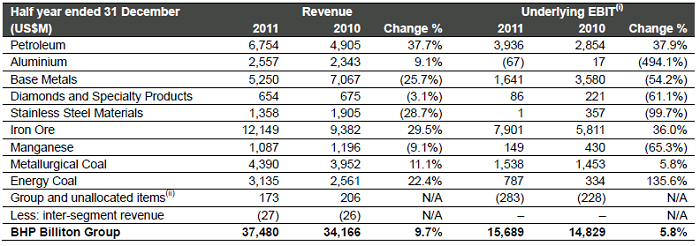

BHP Billiton released their first half numbers this morning, and they were slightly lower than consensus. Expectations were for around 10 billion Dollars worth of profits for the first half, but the company reported 9.94 billion Dollars worth of profits. Which was 5.5 percent lower when compared to the 10.7 billion Dollars reported this time last year. This is only for the first half, 10 billion Dollars (well nearly)? Huge. Revenue was 9.7 percent higher at 37.48 billion Dollars. Basic earnings per share were 186.8 US cents, the dividend was hiked to 55 cents per share. In Rand terms at the current exchange rate, that is 7.57, this translates to 1414 ZAR cents worth of earnings per share and a dividend of 416 ZAR cents per share. Does the stock look cheap then at last evenings close of 259 ZAR? The short answer is yes.

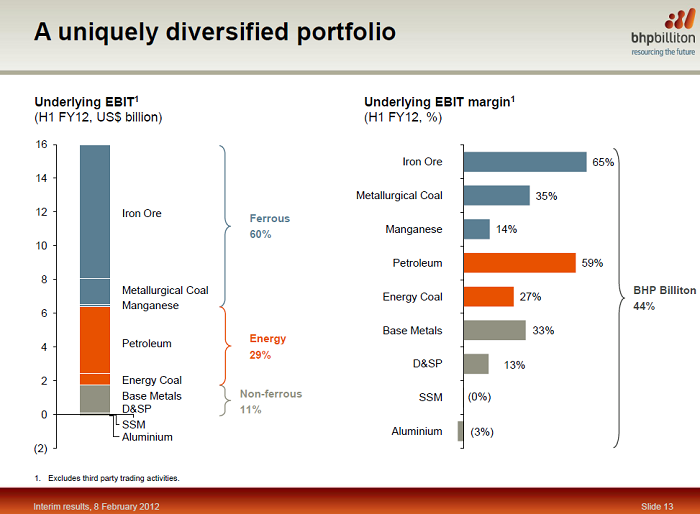

This is quite a nice slide from the presentation, which you can download here -> Interim results Half year ended 31 December 2011. This is from page 13 titled "A uniquely diversified portfolio".

Well, I would not go too far and say that they are uniquely diversified, but I think relative to their competitors, far more diversified. But this is actually what I mean, you can see that they have become less diversified from an earnings point of view from this time last year:

Iron ore EBIT is more than half now (50.36 percent to be exact), last year it was 39.19 percent. But remember that the first half iron ore production put the full year run rate at 178 million tons per annum, but BHP Billiton guided that they would produce around 159 million tons for the full year. Petroleum EBIT has increased to one quarter of the total, whereas last year it was 19.25 percent. Met coal's contribution was basically unchanged at 9.8 percent, this year and the last, all weather problems included. It was base metals that got clobbered, EBIT contribution in this half was 10.46 percent of overall EBIT, but last year it was nearly a quarter. And you can point all of those fingers at one operation, one massive copper mine, Escondida. Revenues halved and EBIT shrank by nearly 70 percent. Seeing as it is their biggest copper mine, I guess then we are not surprised with the big fall off in the contribution from base metals. The fall off was as a result of lower grades and industrial activity.

Before you need to reach for a brown paper bag, in their presentation, BHP Billiton make it clear that this mine should return to old ways: "A substantial increase in copper production at Escondida as operations progress towards higher grade ore in the main pit" is forecast. So things should return to as close as to normal with a mining asset.

Also in the positive column, for the outlook for their heavily hit coal division: "Queensland Coal positioned for strong production growth following the weather related challenges of the last twelve months." Of course, barring any other extraordinary weather events, those cannot be planned for.

And good news for their petroleum assets in the Gulf: "Development drilling at non-operated Gulf of Mexico facilities to deliver an increase in high margin oil production following a recovery from the drilling moratorium." Excellent.

Perhaps most important in their current contributions though, is that their Western Australia Iron Ore operations are expected to increase from a run rate of around 159 million tons per annum to around 200 million tons per annum by 2014. And this is without any additional major project approval. Most of that Capex has been approved already. I guess, as it is with all of their other commodities that they produce, the price is key here.

That is of course key to almost everything here, the prices of the commodities that they produce. Because the prices should be determined by demand. They do list a number of risks and uncertainties: "Influence of China and impact of a slowdown in consumption" and "Increased costs and schedule delays to our development projects."

There is always a detailed outlook segment, which is split up into two different parts, the economic outlook and the commodities outlook. Let us see how their folks see the global economy first: "The first half of the 2012 financial year had its challenges in terms of global economic growth reflecting continued difficulties in Europe and slowing levels of activity in the high growth economies of China and India. Two bright spots were the United States, which saw stronger growth on the back of robust performance in the manufacturing sector, and Japan, which saw a rebound in activity following the impacts of the March 2011 tsunami."

So the developing world demand is slowing a little whilst the developed world, sans Europe is improving. But they do not expect an acceleration on the part of the Americans or the Japanese. None of us do, I guess, but there are signs, particularly in a US context that the economy is improving. And in fact beating low expectations. The long term theme however remains in place, and this is one of the reasons why we have held the stock for a long time: "In the longer term, we remain positive on the outlook for the global economy as the drivers of urbanisation and industrialisation in China, India and other emerging economies are expected to underpin global growth and robust commodities demand."

For a shorter term view, we look towards the commodities outlook. Where I guess they state the obvious: "We expect volatility in commodity markets to persist as the European sovereign debt crisis and general weakness in the manufacturing and construction sectors across key markets are expected to weigh on customer behaviour and sentiment." So, until it is sorted, whatever conclusion you really are expecting, expect the European outlook to be fuzzy at best.

This is the juicy part however: "However, we expect underlying demand growth rates to remain robust, so long as the macroeconomic policy setting of the developing world retains a growth bias. Of the commodities, copper and iron ore are expected to remain supported by their compelling supply-demand fundamentals while the structural shift in Chinese demand for metallurgical coal remains well entrenched. Geopolitical factors are once again likely to influence crude oil pricing. In contrast, the outlook for the aluminium, nickel and manganese alloy industries remains challenging and has led to significant margin compression for most producers, almost irrespective of their position on the various global cost curves."

This seems to have their mix in the sweet spot then, am I right in presuming that? Of course they would say that. I saw on the Twitter thingie that Chinese electricity consumption was lower by 7.5 percent versus the prior January. Some have said Chinese New Year, some have said, no wait, warmer winter than usual. Until of course just a few days ago. Either way this is not a positive.

With the short term outlook a little cloudy, the long term outlook is a little more positive. Even if it is less predictable. The commodity mix is right, even if it is skewed a little this half. We buy into long term industrialisation and urbanisation in China and India, which does lead to higher resource consumption per capita. You are being more than compensated for these risks in the current share price. It is cheap, very cheap. And if you needed reminding, it is the premier mining company on the planet, the best quality assets, a great management team and the least volatile earnings amongst their peers. We maintain our bias to the company and continue to buy the stock.