Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Some company news from one of our most held companies in our client base, BHP Billiton this morning has released their production report for the half year to end December. There are many highlights in some very key areas, including a record annualised iron ore production in Western Australia of some 178 million tons. Copper volumes increased 27 percent in the second half of the err.... first half of their financial year. A good second half to the first half. Petroleum production increased 36 percent, thanks to the recent US acquisitions.

Straight into black gold, the petroleum division, which produced 109.38 million barrels of oil equivalent for the half. The December quarter showed an improvement of 13 percent over the September quarter. The big shift has come in natural gas, up 108 percent, but we knew this was going to happen with the acquisitions of both Petrohawk and Fayetteville gas assets. As BHP Billiton notes in the commentary: "Natural gas production was higher than all comparable periods reflecting strong performance from the Onshore US and Angostura (Trinidad and Tobago) businesses. Gas production in eastern Australia was down against the September 2011 quarter due to lower seasonal demand."

Base metals recorded lower across the board comparative period volumes, but as mentioned above there was a strong rebound in copper production in the December quarter when measured against the September quarter. Wait for it, this was a result of a recovery from industrial action. Yes, read strikes in the September quarter. But also as a result of an improved Olympic Dam performance, which produced higher grades of copper as well as "improved smelter availability following the planned outage in the September 2011 quarter." Check out how far away from everything the town of Roxby Downs is, the town that services Olympic Dam.

If Wikipedia was working properly I could tell you a little more about the town. Check out the reasons behind the Wikipedia blackout today -> SOPA and PIPA - Learn more. Roxby Downs is nearly 600 kilometres from Adelaide in South Australia. And we all know that Adelaide is to Australia what Kimberly (or perhaps Upington) is to South Africa. A distant place that is a regional capital of sorts. The good news for BHP Billiton is that the copper price has been improving rapidly, thanks in large part to decent enough Chinese economic indicator.

The other big division is their Iron Ore division, where the half managed to record a 22 percent improvement of the corresponding 2010 period. And the company managed to produce 4 percent more iron ore in December quarter over the September quarter. All in Western Australia in one of the most sparsely populated regions in the world, the Pilbara. The improved performance was thanks to "Consistently strong operating performance, the ramp up of Ore Handling Plant 3 at Yandi, dual tracking of the company's rail infrastructure and additional ship loading capacity at Port Hedland all contributed to the record performance." For the full year however, BHP Billiton will not achieve that 178 million tons, scheduled maintenance and the wet season will see the company clock somewhere in the region of 160 million tons.

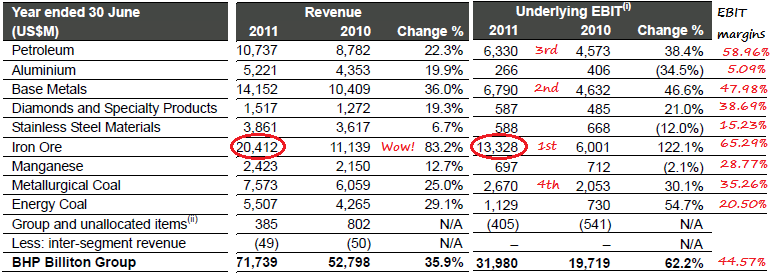

Coal, that is I guess the fourth most important division of BHP Billiton, you can see what I mean by that from this table of their various divisions from their annual results last year, in a message titled BHP Billiton looks cheap. A refresher:

Metallurgical coal has much higher margins than Energy coal, the quality of course. First the high quality coal, a few problems, but higher production, 9 percent higher for the December half over the prior one. "Queensland Coal (Australia) volumes for the December 2011 quarter remained below capacity as a result of stoppages associated with the ongoing labour negotiations and the remnant effects of wet weather. In addition, geotechnical issues at the Gregory Crinum longwall adversely affected production in the period. While system capability is no longer constrained by the 2011 floods, the extent to which industrial action will continue to impact production, sales and unit costs is difficult to predict."

Well, let us HOPE that the Queensland floods will not be repeated. It is worth noting that sometimes a snarky remark when speaking about agricultural companies and reliance on the weather. Well here goes, the world's premier mining company was heavily impacted by the weather. Heavily impacted. Energy coal achieved half year records in New South Wales (thanks Michael Clarke), but noted that "unfavourable mining conditions and an industrial dispute at South Africa Coal, together with the suspension of operations at San Juan Coal (USA), resulted in lower production relative to the September 2011 quarter."

On balance the report seems quite favourable. Petroleum and Iron Ore are major divisions that are pumping for lack of a better word. Coal production is fine, but not without their problems and the issues that their copper assets have had seem to be working their way out of the system. The stock is marginally higher here at the open. The stock closed higher by just over four fifths of a percent in Aussie, down under, Nadal had a similar type of performance in Melbourne. We continue to accumulate the stock.

Next, the BHP Billiton exploration and development report, which gives you valuable insight into the direction of the business. Where they are geographically and which assets are they focusing on. As the company says: "A focus on high return growth projects, diversified by commodity, geography and market was further reinforced during the December 2011 half year with the approval of projects in the Metallurgical Coal and Energy Coal businesses. BHP Billiton's commitment to its world class growth pipeline now exceeds US$26 billion."

26 billion Dollars? Wow. Gas, gas/liquids and LNG development in Australia accounts for some 4.5 billion Dollars of approved capex. A massive alumina growth and efficiency project in Aussie of around 3 billion US Dollars will yield around 1.1 million tons per annum. Almost complete that project, 6 percent to go! And then the big one, 7.3 billion Dollars worth of capex in various Iron Ore projects in Western Australia. That is the bulk of the spend. Add in another 1.75 billion Dollars worth of capex in the Samarco iron ore project in Brazil and you have over nine billion Dollars. Wow. 4.6 billion Dollars has been allocated to various Metallurgical Coal projects in Australia.

That is the development part, the exploration part is not for sissies. Copper targets in Zambia, Mongolia, South America and Australia have been identified. "Exploration for iron ore, potash and uranium was undertaken in a number of regions including Australia, Africa and the Americas." seems more than a little vague. However, these activities account for spend of 532 million Dollars for the half year. That is right, annualised at more than one billion US Dollars, thanks so much shareholders, but this is what you get with a mining company.

There wasn't too much luck in their Gulf exploration for the half, but there were two hits on partial ownership of wells. Now, I can hear you howling that this seems like money badly spent, but I can promise you that I would prefer this. As Paul pointed out, what you do NOT want is the expensive Ravensthorpe Nickel development that BHP Billiton closed in January 2009. They wrote off nearly 4 billion Dollars worth. See what I mean? You would rather pay the school fees. I hope I got that.