Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

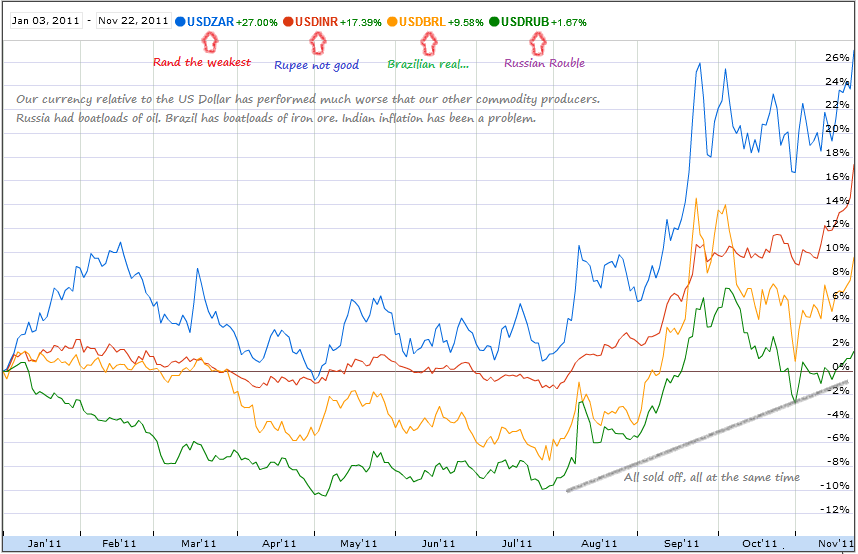

It has nothing to do with us. At least not in the short term. I said to Byron, darn, the selloff in the Rand coincided with the parliamentary vote (see below, I guess you know already) but in actual fact the currency all fall down had probably very little to do with that event. Like I said above, another look at Q3 US GDP fell short of expectations, at almost the same time. So how do I know that the selloff in the Rand has nothing to do with what we get up to here? Simple, I shall present two exhibits, first via Joe Weisenthal, I mean the @TheStalwart is where you can find him on Twitter.

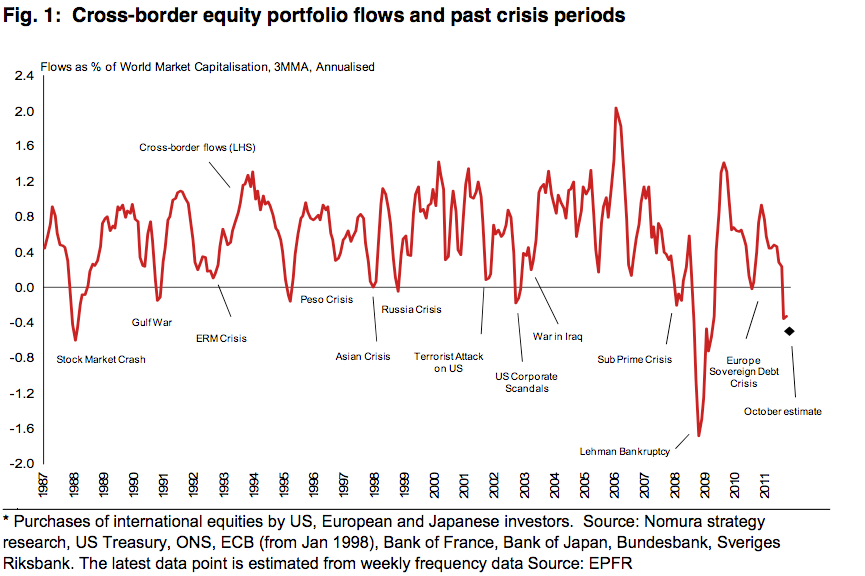

This graph from Nomura illustrates how folks from the developed world reign in external investments, so they would be natural buyers of US Dollars, Yen, Euros, Swedish Krone, Swiss Francs and natural sellers of everything else. Well, almost everything else, but that everything else would mean South African Rands, Indian Rupees, Brazilian Real (turns out not really), anything that you can trade in and out of quickly and easily. Deep and liquid markets is what investors (traders) are after. In their pursuit of happiness higher yields. Here goes that graph:

So basically, in a time of crisis, developed world money goes with what they know, and if that means owning short term or longer dated government bonds, then so be it. Even if that basically means in real terms that they are going backwards. That is something that they know and trust. Here are the weakening currencies of India, Brazil, Russia and ourselves year to date, and you can see how in this period that nobody has been spared.

I think what I am trying to illustrate is that the selling of our currency is related to the cashing in of foreign assets by developed world money, there is nothing sinister to this. This graph is actually more telling. More telling, because it is much longer dated.

Brazilian interest rates have been "high" for a long time, and money looking for a safe place to park their funds, have flocked. Or higher yielding bonds. So there. I am sure that I have allayed some of your fears as far as the currency goes, or at least the weakening currency, which has a really big inflationary impact.