Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Byron's beats You have to hand it to Tiger Brands, they seem to deliver time after time, year after year. They have unbundled some quality (with a q and not k) companies along the way. Spar, Adcock Ingram, Astral Foods spring to mind. Tiger itself was unbundled from Barloworld. Barloworld bought a major chunk of Tiger back in 1982. So perhaps the argument is circular, in terms of what has been unbundled and what has not! I know that out there, a reader, who I know, lived through the investment as a shareholder, perhaps he can send us the full story. Byron reviews Tigers results from this morning:

This morning we had good solid full year results from Tiger Brands who managed to increase turnover by 5.8%, normalised headline earnings per share by 5.7% and a dividend increase of 6%. Actual earnings growth for the year came in at 17.5% because of a once off gain from the recognition of National Foods Holdings as an associate. In fact they have held a 25.7% stake in the Zimbabwean business for years now but this is the first time they can realise their share of the earnings as things actually improve there. Nice to see.

The execution of the business seems to be going well. Although turnover increased 5.8% to R20.4bn, volumes declined 2.3%. The increase was attributable to 30 basis point increase in operating margin and increases in prices. Headline earnings per share came in at 1575c with a full year dividend of 791c being paid. At a current share price of 22500 this means the stock trades at a historic valuation of 14.2 and a dividend yield of 3.5%. A fair enough valuation for a defensive company like this but the yield is not great. They are sticking to their 2 times cover policy which I suppose allows them some leeway for future acquisitions, especially up in Africa where they spent R2.1bn last year.

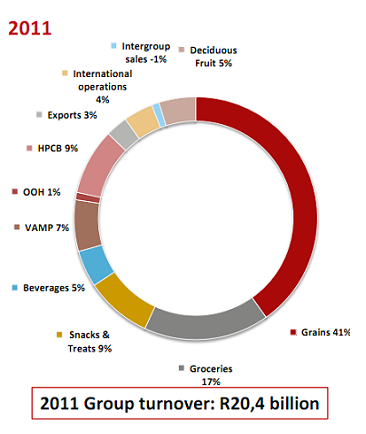

In terms of contributions to revenue, a picture says a thousand words so I took an image from their results which tells the whole story.

If you are unsure OOH stands for Out of home which will include their associate businesses. VAMP stands for Value Added Meat Products which includes the Enterprise brand. Sasha went to their target="_blank">website which showed some amazing stats. See that the Polokwane Facility has the capacity to manufacture 1.3 million vienna's per day and 500 tons of polony per week. Phenomenal! HPCB stands for Home care, personal care and baby care with brands such as Purity, Elizabeth Anne and many others.

See that grains are still the main part of the business and are responsible for 54% of profits. People love their staples which include oats, maize meal, rice and of course bread. Their consumer brands also remain very strong with KOO being voted South Africa's favourite brand (not sure how that came about, I don't remember voting). All Gold, Energade, Oros, Black cat and Beacon just to name a few. These are products we all know and consume regardless of how things are panning out in Europe.

All in all a good operation with strong ambitions to expand their footprint in Africa and increase exports. They are very cautious about the future with unemployment issues and less disposable income keeping conditions tough. However they feel their diversified portfolio will be able to handle these pressures and still provide growth. We like the company as a good defensive stock with a decent yield. However it does lack excitement in terms of world changing innovations which I suppose may not be such a bad thing when times are tough.