Byron's beats has a look at another of our favourite stocks. McDonald's. What I have learnt in this business is that you don't really have to like the product, or approve of the product, you must just know what the consumer is up to. I must admit, one will have to watch the fast food space closely in anticipation of greater government intervention in peoples lifestyles in the future, the Danish example springs to the top of my mind immediately. And why do governments across the globe want to do this? Because if people want access to universal health services, then you must make sure that they are healthy. McDonald's have tweaked their menu to provide healthier options, wraps, salads, but I suspect that there is still a long way to go. They even serve Oatmeal and the McCafe has become HUGE, bigger than they might have suspected. Fruit smoothies and Frappes are quite a hit too, that is a recent launch, last year.

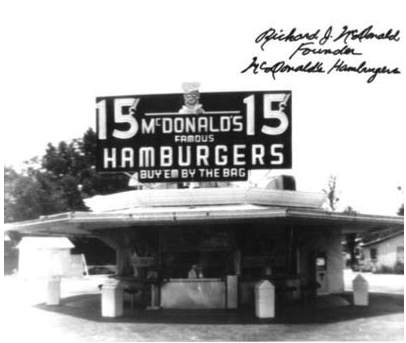

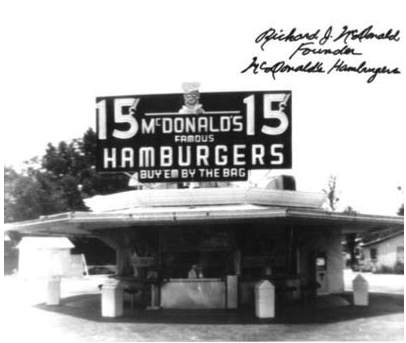

Byron sent an email that contained some "rare" pictures, including this beauty, the very first McDonald's and signed by the owners at the time:

And then their first advert, this is quite fun: McDonald's Corporation first magazine advert. A little historical background to the company, now that you have seen their first outlet and first advert. Ray Kroc actually was the father of the business, not really the McDonald's brothers. The stock first listed in 1965. 22.50 Dollars a share. But before you get too excited, they have done many splits over the years. In fact on Google finance (which goes back to 1978) the share price is up 7353 percent in 33 years. They have paid 112 dividends since the beginning of 1978. Adjusted for the split that equates to over 15 Dollars worth of dividends. They have become more generous over the years. More than just a brief introduction to their last earnings report, which was Friday, here are the beats of Byron:

Whoa, that nearly slipped through the gaps. We looked at them but forgot to relay them on to you guys. I'm talking about the McDonalds's results which came out on Friday and beat expectations. This was mainly due to a strong increase of same store sales in September whilst consensus for October looks to be just as strong. This was a nice surprise as Europe managed to blast expectations especially in France and Germany where results have been fairly choppy in the past.

Global comparable sales were up by 5% with the U.S increasing 4.4% with a 6% increase in operating income, Europe by 4.9% with a 6% increase in operating income whilst Asia, Middle East and Africa increased 3.4% with a 15% increase in operating income. Diluted earnings per share came in at $1.45 which was up 12% against the comparable period. However they report in dollars and because of the strength of the dollar over this period, currency adjusted earnings were up 6%. The share trades at $92 with earnings for the year expected to be around $5.22. That puts the stock on a forward multiple of 17.6. Some may say that is expensive but for a company expanding heavily in developing economies and is seen as recession proof I would beg to differ.

I took a read through the investor's conference call and things certainly seem positive. Consensus looks good going forward as the McDonalds strategy seems to be working. This is what James Skinner, the CEO had to say. "McDonald's continues to drive results around the world by offering what customers are looking for today more than ever: great value, outstanding convenience, a modern restaurant experience and relevant, great-tasting menu offerings".

Not all was happy days however, if you are interested, href="http://seekingalpha.com/article/301307-mcdonald-s-ceo-discusses-q3-2011-results-earnings-call-transcript" target="_blank">check out the interview where you will see that the environment they are operating in is extremely tough and competitive. "The stock market just ended its worst quarter in 2 years, and many major economies are barely growing, if at all. Consumers everywhere continue to be cautious and hesitant to spend, and the informal eating-out industry is growing at a very slow pace. So we remain in a market share battle, with every victory continuing to be hard won". Food inflation has also been a tough challenge. However they state that their extremely competitive prices have room for increases.

The increase in dividends will also please investors with a 15% increase recently being announced. The company has also implemented a few share buybacks which proves their strong financial position. We like this company because it falls within our aspirational consumerism theme. Everyone loves McDonalds and believe it or not, many people who are entering the middle class from a poverty stricken background aspire to eat there once in a while. At the same time it is also defensive as people downgrade from fancy restaurants when times are tough. They really do offer good value. We continue to add at these levels.

Hah-Hah, we continue to supersize our positions from here. Err... hold the mayo.