Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Let us take a quick look at the Anglo American production report from last week, this is for their third quarter to end September 2011. You can have a full read through of the report by following the following link -> Production Report for the third quarter ended 30 September 2011.

As it was with BHP Billiton there were grade issues with their copper assets, although they do say that copper output for the full year should be about the same as it was last year. As they say in the statement: "Production decreased by 9% to 139,900 tonnes, mainly due to lower grades at Collahuasi, Los Bronces and Mantos Blancos, and weather related interruptions at Collahuasi. This was partially offset by higher production at El Soldado, which benefited from higher ore grades following recent mine development." More important to this whole discussion around their copper assets, a refresher from 11 days ago -> Anglo American could be a forced seller of their premier copper asset. That is the nearly 10 billion Dollar question. Which is huge in their case, I am guessing that the next three months (because those are the time frames) will reveal the answer.

Iron Ore, another key division showed a three percent increase when compared to the corresponding quarter last year. What was quite interesting was that supply to the local market fell, so that presumably is not great news for ArcelorMittal, but that is not really new news. I have seen and read many concerns about the Brazilian iron ore expansion, the export market there is still smaller than the local iron ore market here. And at its height, it will not be bigger than Sishen in its current form.

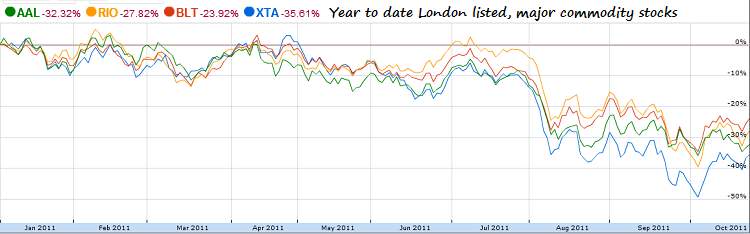

On balance the production report was decent enough, and was mostly in line with most peoples expectations, the stock price however like all of the major producers has not done well this year. But Anglo has done slightly worse. In London Anglo are down just shy of 32 percent this year, BHP Billiton are down nearly 23 and a half percent and Rio Tinto are down 27 and a third percent. Xstrata are down 35 percent year to date and are the only one of the majors that have done worse than Anglo American. Why do you think that these two have been given a more significant mark down relative to their Australian peers? Not sure, perhaps someone can answer that probing question for me.

Here is the hacked graph from Google finance, showing you the majors and performance Year to Date. Yeah, not great for the whole group. To make yourself feel better, go and take a ten year view on all of these stocks and their share prices.