Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

The guys next door to us reported results for the full year to end June 2011. The guys next door are the Bidvest Group. I wonder if that sign is still up in their lobby that read: "We refuse to participate in the recession". Yes, me neither!! Jump straight into the numbers like I did in the pool yesterday (it was incredibly cold!!). Revenue increased nearly 8 percent to 118.5 billion ZAR, trading profit increased to 6.1 billion ZAR (up 9.1 percent) which translated into an 8.2 percent increase in HEPS to 1157 (point four) cents per share. And a dividend of 480 cents per share for the full year, . 143.49 ZAR is where the price closed on Friday, so pure vanilla simple valuations sees the stock trade on a yield of 3.3 percent and on a price to earnings ratio of 12.4 times. Not that stretched really. But there has been recent disappointment by the short term punters as the Bidvest board abandoned approaches to unbundle the food services business.

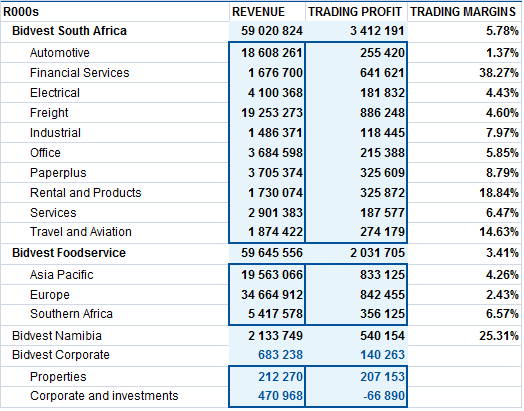

Many folks see Bidvest as a barometer of the economy, but that was perhaps more true in the old days when they were mostly South African focused. That is not true anymore, they are now well diversified, from a geographical point of view. Divisional breakdown if you please!! This is hacked from their presentation on their website, which is really well done, whereas the release on SENS is not good, poor formatting. Check out the website rather, where I am interested in the Segmental analysis:

See that, the Bidvest South Africa division and the Bidvest Foodservice contribute almost the same revenue as each other. Amazing. And also, as you can see, Asia Pacific and Europe, inside of the Foodservice business are the two top revenue contributors across the whole group. And are nearly the top contributors in terms of trading profit, but that honour belongs to the local freight business. And the best margins across the group are with the financial services division, and a long way behind but in second place is the Namibian divisions. Whatever they are doing there they must be doing it right!! Driven by, would you believe "High catch rates and firm prices underpinned exceptional horse mackerel results." Yes, fishing!! Turns out there are lots of fish in the sea.

It is amazing to read through the detailed report of the results, division by division. Selling motor vehicles is a tough old business, not good at all. New vehicles sales were up, used vehicle sales were down, loads of small vehicles being sold, and as gasoline prices increase, the trend should continue. But smaller margins in smaller vehicles. There is also "stuff" that you know already, the construction industry is still broken, I mean slow.

I like the way that Bidvest sums up the freight division of theirs: "Challenges related principally to rail freight bottlenecks and congested harbour and road infrastructure. Freight teams maximised the opportunity presented by continued strong commodity demand and improved trade volumes." Challenges means problems. So the Durban harbour revamp should be all good!! No wait, the harbour has been widened already. Must be the rail infrastructure. Yip, I read into that Transnet inefficiencies. Sis, shame on you Sasha!

Other divisional reports revealed some telling signs of perhaps mature businesses and newer business, with the technology business in the Office division doing well, and stationary faced "continuing" pressures. If you know what that means, I have a pen sure, but I look for ways not to use stationary. Another telling sign of a segment of the economy that is looking iffy was short and sharp: "The Boston laundries business was impacted by low hotel occupancies and intense garment rental competition resulting in the cost base being reassessed. Hotel Amenities had a poor year." Yip, we know that.

And then the all important Foodservices business. Aussie looked fine, notwithstanding the big Queensland floods, further away from the rest of the world, New Zealand looked alright, again notwithstanding a natural disaster in the form of the Christchurch earthquakes. Singapore looked really good, Bidvest notes in the commentary record tourist arrivals. Yeah, and I thought "things" were so bad. Turns out not really. Some of the smaller contributors in the form of Angliss (but with big, really big hopes) in Asia grew well, Mainland China, Macau and Hong Kong all good areas of operation for the company. Europe looks OK, weak, but OK. Bidvest bought a fish processing and distribution business in the UK, and a couple more smaller acquisitions took place on mainland Europe. Their ice cream business was impacted by a poor summer. The amount of times I hear poor summer and Europe in the same sentence, is when I start to think that the weather is always rubbish in Northern Europe. Quite!!

There was an interesting line in the first part of the South African Foodservices business which might be telling: "By year-end the first signs of improvement in the restaurant channel suggested consumer pressures may be easing." Yes? Good news, people are eating out more and restaurants need more paper napkins, crockery, cutlery, and in fact almost anything you could think of from Chipkins!! Go and check the Chipkins site out, but do not stay too long, there is a temptation to get lost.

The prospects section deals with the unsolicited bids for the Foodservice business, we have discussed that before in a piece titled Bidvest drop the idea of selling the Food Services business, from the middle of August. But then the more important part of, how are they doing? The way that I read the last bit is that whilst in most of their geographies the economy is still sluggish, the group is well placed.

So, keep calm and carry on. And keep trusting the Joffe magic. Because for shareholders there certainly has been a lot of magic, if not recently, then over the last two decades. I rewound to 1991 to look at the results. What a hoot, annual turnover was 411 million ZAR. Profits were nearly 17 million ZAR. The company delivered 34 cents worth of HEPS and paid a dividend of 12 cents a share. The stock traded at a high of 282 cents and a low of 180 cents. Phew, like I said Joffe magic. And quality attracts quality staffers. So I am not too worried about succession at Bidvest, and besides, Mr. Joffe said he was not going anywhere in a hurry. This might not be the most exciting company to own, but certainly is one of the best run.