Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

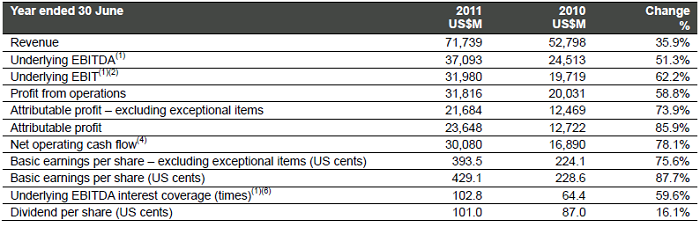

BHP Billiton released their full year numbers this morning. Byron was so excited (notwithstanding not making the squad) that he has not slept in the days leading up to these results. The immediate number that jumps at you is what looks like a big beat in profits, expectations that I had seen ranged from 22.1 to 22.5 billion USD of profits, the actual number came in at 23.648 billion. That is a comfortable beat on profits. Basic earnings per share reported came in at 429.1 US cents, the dividend declared was 101 US cents per share for the full year, the final dividend is 55 cents. I remember a time when a client was disappointed with one quarter of the current dividend around five years ago. Revenue was up 35 percent from last year to 71.7 billion US Dollars. Huge. Massive.

Here are some of the highlights (from their highlights segment), which I thought were important and noteworthy.

"Record production across four commodities and ten operations."

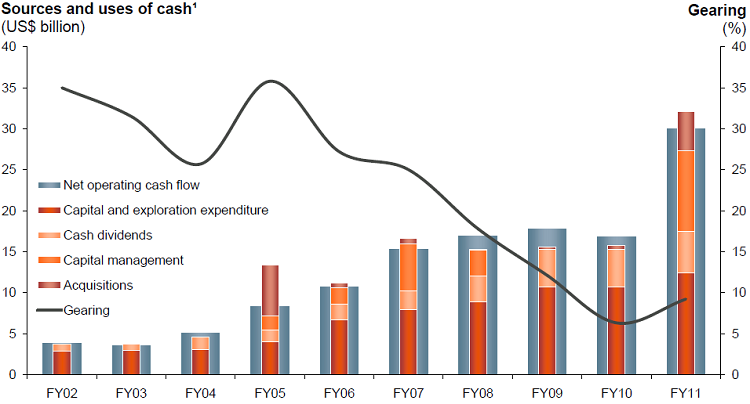

"Record operating cash flow of US$30.1 billion and gearing of 9% confirms capacity to comfortably fund the Group's US$15.1 billion acquisition of Petrohawk Energy Corporation and extensive organic growth program."

Here are the numbers in a table hacked from their press release Report for the year ended 30 June 2011. Just have a look at the right hand column, the increases on last year. Massive.

Notwithstanding the purchases of Chesapeake Energy Corporation's interests in the Fayetteville shale (USA), Petrohawk Energy Corporation and a US$10 billion capital management program, net gearing at the end of the 2011 year end was at nine percent. Read that part again. Net gearing after all this activity at a mere nine percent.

The outlook part (yes, right at the beginning of the piece) is always more than a little interesting. Two separate outlooks, one an economic one, another being a commodities outlook. I was going to look for snippets, but could not decide which part was more or less important, so for the economic outlook, I copy pasted it all:

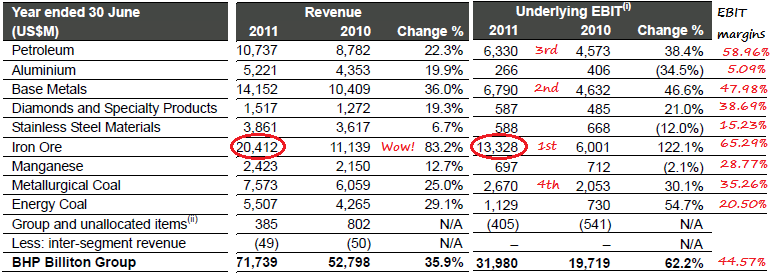

The group strangely, because of a monster performance from their iron ore division, is not as diverse as perhaps we saw last year. And that is through no fault of the other divisions, it is just that iron ore prices and volumes have been so strong. Strong, very strong. The iron ore division now contributes 41.7 percent of EBIT, I guess it is no coincidence that that division has the best margins too across the group. 28.5 percent of overall revenues, it is the largest by sales too, across the whole group. Second spot belongs to base metals, with both the second best EBIT contribution (21.2 percent) and second in group sales (19.7 percent). The petroleum division is third on the list, with the second best margins, and contributes 15 percent to overall revenue but 19.8 percent to overall EBIT. So add these three up quickly and these most profitable divisions contribute 82.7 percent to EBIT. Add in Metallurgical coal to the mix (in fourth place) and overall EBIT contribution (from these four) rises to 91 and a bit percent.

So I guess you know where the focus is now, let us just say that it is not on Diamonds and Manganese, even though those margins are not bad at all. Nice to have those, no matter what business you are in. This is a bit of a kyk veer (another look again, good here, bad when it is served on Sunday evening dinner) from some of the stuff that we mentioned above, but this slide is possibly one of the most important from the presentation:

The gearing the part is important, because there is as much as 80 billion Dollars worth of Capex all the way to the end of 2015. So, no wonder the gearing is low now, expect that to rise rapidly in the coming months. Operating cash flows are strong. Very strong.

Next question. Why does the stock look so cheap? Basically it trades on half the valuation that it did at the height of the bull market in 2008. HALF. Paul was grumbling here, saying what is the problem with the balance of the market participants, why are they discounting the stock so much? Does the future look that bad for their products, or is the fact that the Chinese are moderating their growth (from 10 to 8 percent) a big problem? Is Michael Pettis right in this piece? ---> Michael Pettis On The Major Adjustments That Will Follow The End Of The Globalization Cycle.

So the few analyst reports that I have seen have suggested that we could see a twenty five odd percent increase in earnings to next year, which means that forward the stock trades at less than 6 times earnings. What? And the price targets suggest as much as fifty percent upside from here. What? So, is the sentiment weighing on the stock and the uncertainty around a complete global recovery too much for folks to get excited at these levels? Maybe. We would like to think that the trends are still intact and are still buyers at these levels.