Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

The Cisco disco actually happened after hours, after the US markets had been crushed. An earnings beat and I could hear the collective sigh of relief. Phew. Net sales were three percent higher than the comparable quarter this time last year, gross margins more importantly have stabilized. Costs also seem to have stabilized, as a percentage of revenue. 11.195 billion Dollars worth of sales in Q4 which translated to a bottom line of 2.195 billion Dollars (12 percent lower than this time last year), translating to 40 US cents worth of earnings. Remember included in these results are the whole host of restructuring charges, mostly related to the early retirement program and employee severance packages. For the full year the company made 162 US cents EPS, which was a penny better than last year.

The services and new products divisions grew strongly, whilst the router and switches business quarterly revenues dropped. Inside of the new services division the wireless and data centre segments surged, both over 30 percent. Security product revenues plunged by 20 percent. Darn, I used those two words, surged and plunged, I made a little promise to myself not to use those words.

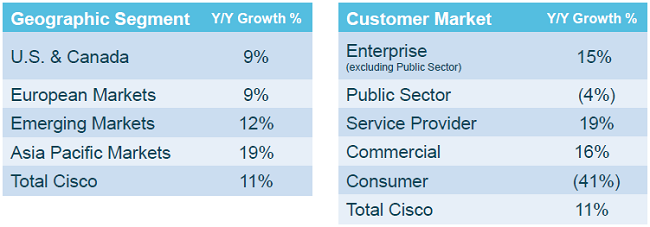

The one slide that is worth sharing from the presentation titled Q4 Fiscal Year 2011 Conference Call is on page six, Q4 FY'11 Product Orders: Geography & Customer Market. The most interesting part was that the Enterprise customer market (in this slide) was reported sans the public sector. But 9 percent growth year on year sounds awesome to me, that is in the US, 19 percent in Asia Pacific.

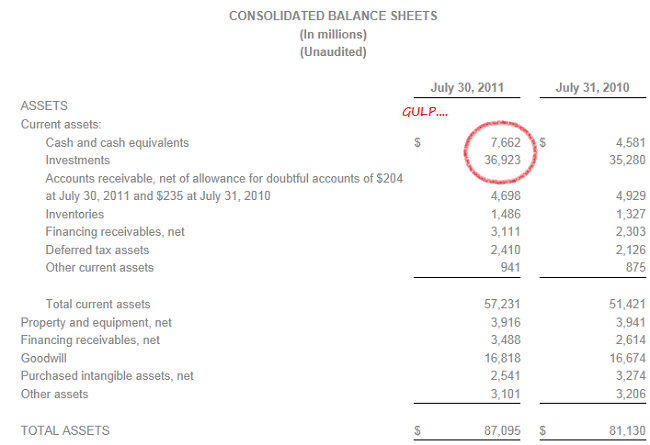

Another 6 cent dividend. Hardly a king's ransom really. But it is probably the start of a bigger program. They say that seeing is believing, so here is the staggering figure again, cash and cash equivalents AND investments tallies up to 44.585 billion Dollars. Gulp. Check it out:

Wow. And breath. OK, so what to do next then? The stock over 52 weeks is down a whopping 42 percent. Yech, that is just awful. However the stock was up 6.63 percent post market and expect the pre market trade to see us settle at some sort of level. The trailing price to earnings multiple is less than 11 times and based on earnings estimates to next year, trades on around eight times earnings. And the piddly quarterly dividend of 6 cents per share, which equates to 24 cents sees the stock yielding 1.7 percent. Amazing. And reminder everybody, the ten year yields 2.2 percent. 2.2 percent? And the two year yields 0.18 percent. Yip, I know which one I would rather own.

There is still a long way to go for long suffering share holders. But I am with Cisco here. More and not less of ordinary every day activities will take place using the internet. Out with books and the like, in with things like the internet TV, smarter and smarter handsets, tablets and the like, you are going to consume a whole lot more data over the internet. Cisco will benefit. Cisco looks cheap. Cisco as a company have done a lot of soul searching. Tied into that, check this piece, via a Paul Kedrosky tweet from yesterday: Infographic: App Store Growth Compared to McDonald's Burgers.