Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Loads of results this morning, let us try and get through all of them. First, most important Vodacom have released their full year numbers to March 2011. Just to remind people, if this business was a person, they would be eligible to vote for the first time this year (from date of registration in 1993). And at the close Friday had a market capitalisation of just shy of 119 billion Rand, which places it 12th on the listed entities, twice the size of South African insurance giant Sanlam which was founded in 1918. Upstart, 75 years their junior and twice their size. These are reasons we often give for why the future is almost always brighter than you think, there are always transformative industries that overtake older businesses. And transform the older businesses often for the better.

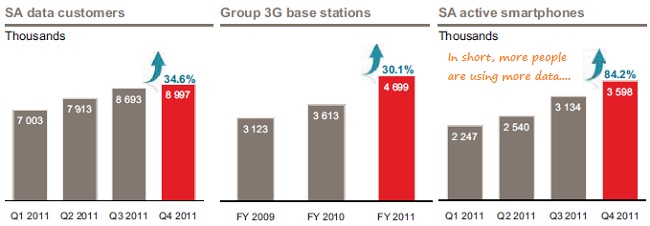

Enough of that, let us dive straight into the numbers. Headline earnings have surged 28.6 percent to 656 cents per share, the dividend has been hiked by 60 percent to 280 cents (for the half, 460 for the whole year), which represents real confidence in future cash flows. I guess this is the way that the majority shareholder gets their money back, think Kumba/Anglo and ABSA/Barclays. All this with modest revenue growth. You can see pricing is going to be key in the voice space, because voice traffic increased 19 percent. Really strong data revenue growth, up a whopping 35.5 percent. With data users in South Africa (all networks) growing at about the same pace, up at 9 million users. Total subscribers were up to 43.5 million, an increase on last year of nine percent.

Apart from another write down of that Gateway asset in Nigeria, these are a sparkling set of results. Impressive all around. With a distinct lack of subscriber growth (only around ten percent over the last 24 months) the data growth confirms what we think long term. More smartphones, bigger data networks with data representing a much bigger portion of overall revenue is where we see the growth, with the existing voice revenue perhaps standing still for a while. Whilst the call rates get cheaper, the actual usage increases significantly. This is confirmed here: "Total ARPU is reported as 18.9% higher year on year to R157 largely due to the disconnection of 3.3 million SIM cards, the increase in average minutes of use of 27.5% to 102 minutes, offset by a reduction in the average effective price per minute of 11.3% and lower interconnect revenue."

If you want to check out some cheerful data on the South African mobile market and in particular, the results presentation from Vodacom, then download it via this link ---> Annual results presentation. Check out page six, where the goal is to have 25 million data users by the year 2013. Here is a little graph:

Nothing ex growth about these mobile phone companies. Just a different form of growth. I have seen some analyst reports with price targets very far south of the current price, which is comfortably outpacing the broader market this morning. Up 2 percent relative to a market that is down half a percent. I guess those analysts are going to have to eat some humble pie this morning. Perhaps the same analysts are worried about pedestrian growth going forward, I look forward to seeing notes of sorts in the coming days. If you come across any, please share (if only for my eyes). Thanks.