Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

We had during the course of the day managed to drag ourselves comfortably off the worst levels of the day, which were in the morning prior to European markets being open. Session end the Jozi all share index had lost nearly 39 points to 32298. Banks were lower by nearly 0.4 percent, led down by FirstRand, which closed down 1.85 percent to 1906. Sasol added 0.65 percent, but failed to lead the broader resource space out of the red, that index closed down 0.46 percent. I often wonder if any of this is useful? I mean, this all happened yesterday and has no bearing on the future whatsoever. Nothing. Ah well, we all like looking at the scoreboard, as a cricket nut I love looking at old cricket test scorecards. Don't ask why, I just do.

Now, let us dive straight into those FirstRand results, the last of the big four banks to release numbers for this reporting period. I was talking to an analyst yesterday and he said quarteritis was something that did not plague us, but folks still suffered from taking the numbers way to seriously in the minutes after their release. Granted an earnings miss is a miss, but tell me something, if nobody had a sense of the numbers, then how a) would the stock trade in-between results and b) how would it react after results. In the US where the markets are deep and liquid, after a quarterly earnings release the stock immediately finds a level that market participants think is right. And they are ruthless, if a selloff of a big cap stock ensues, it is not uncommon to see the stock down five percent.

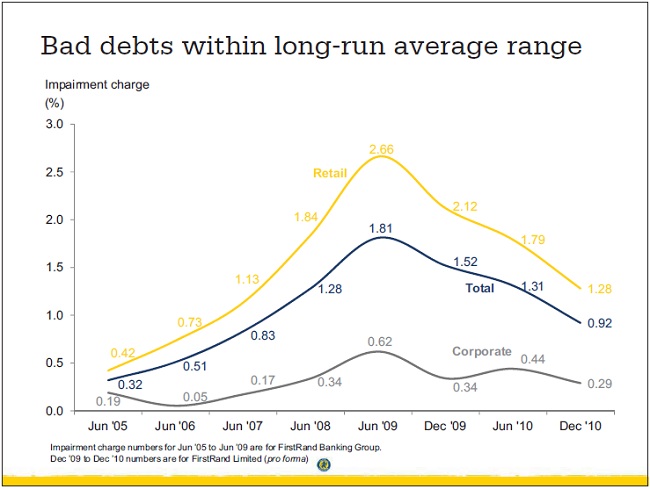

But I digress, as per usual, FirstRand results, let us get back to these. Impairment charges are lower and back somewhere near the long term averages. Check out this slide from their results presentation:

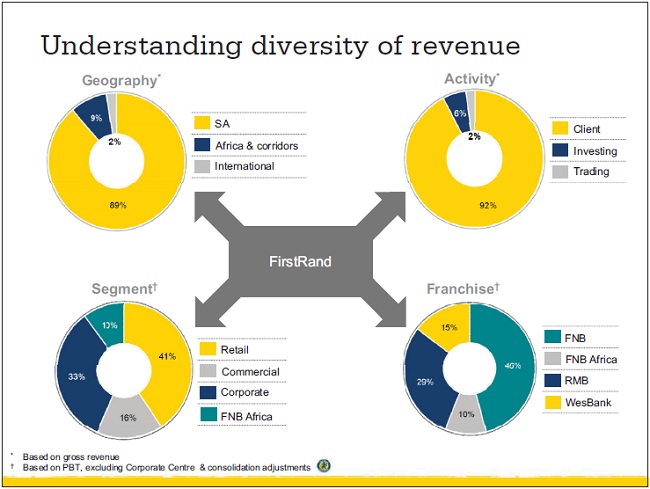

But....as FirstRand point out, non performing loans remain "sticky". Who contributes? Well, there is a *nice* slide from the results presentation that sums it up really well, by franchise, segment and geography.

What does top brass at FirstRand think about it? Well, in the results commentary, CEO Sizwe Nxasana (I am sure he wakes up every day happy that he left Telkom) had the following to say: "We are extremely pleased with this performance which was achieved against a mixed macro picture of sluggish GDP growth offset by low interest rates and an improving credit environment. It reflects the quality of our franchises which have all produced strong operational performances and are showing early signs of success from some of their growth strategies, both in South Africa and Africa"

I must be honest, I really like the fact that the bank is leaner and meaner and the insurance assets have been sold/unbundled. No more Outsurance and Momentum. And some of the functions that these business offered to FNB clients in the past will be taken in house with the full benefit going to FirstRand. Well almost: "Previously OUTsurance and FNB shared profits 50/50. In terms of the new arrangement FNB will receive a 90% profit share."

And with regards to Momentum: "The unbundling of Momentum following its merger with Metropolitan was completed during the period under review. FNB will continue to pursue opportunities to sell Momentum products to its customer base. However, this will now be structured on a preferred strategic arrangement, on a fully commercial basis." Again, I am reading into this that they will cross sell if needs be, and get more of the benefits.

The score sheet. Diluted headline earnings per share were 20 percent higher at 85 cents a share. The dividend clocked 35 cents a share, so I would guess the dividend cover is about the same as everybody else. Impairment charge ratio is at 0.92 percent. Divisionally FNB South Africa had a good half, but again this is the same theme that we are seeing, a bounce back in the retail bank. FNB Africa is very profitable, if not too small at the moment. The bad debt ratio of their African operation is one sixth of that in their South African bank.

RMB did "well" too, even as the commentary suggested a "slow recovery in corporate activity and weak Fixed Income, Currency and Commodities division ("FICC") client flows". It was just the Private Equity division that did worse than the prior year. Wesbank. The spot where you go to get financing for your absolute favourite toy, in the office here motor vehicles are pretty low on the agenda. The youngest vehicle in our office is 2004. Let us just say that cars in this office, she is not beeg.

Capital adequacy ratios seem just fine, and in fact FirstRand suggests they are well positioned for Basel III. Gosh I am sooooo excited for that implementation. Perhaps by the time 2019 knocks around and another banking crisis has unfolded in front of our eyes, we might be talking about Basel IV or V. Probably.

Total advances stand at 453 billion ZAR, actually higher over the comparative period, better than their peers seemingly. Total group assets which include a line that I don't like, investment securities and other investments, which I am thinking includes a stake in RMB holdings, total 695 billion ZAR. Total deposits have increased, along with the other major banks, and currently stands at 543 billion ZAR.

Investment case for FirstRand. Big banks when the going is good equals great returns for shareholders. The consumer is looking in a whole lot better shape than they did this time last year. I like the leaner machine.

Investment case against FirstRand. It is going to be very hard for the go-go days of easy money to be replicated anytime soon. Also, what worries us here is that the Reserve Bank might have to raise rates soon to counteract pending inflation. Just at the point that the consumer is starting to feel positive again.