Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

I listened into the Anglo American conference call on Friday from the comfort of my desk, I didn't have to run to wherever for free sausage rolls (filled with soya for me) and then knock off early. I can't quite understand why people have to go along, but do accept that without them (the attendees) there would be no cameras. But, for someone like me, this is a clean way for analysing the results. Check out these resources and tell me if I am wrong or right ---> Investor presentation - PRELIMINARY RESULTS - YEAR ENDED 31 DECEMBER 2010. And the Video interview (transcript) with Chief Executive Cynthia Carroll, and Finance Director Rene Medori.

So, what is there, other than sausage rolls, free Coca-Cola and to hobnob? To "feel" out management? Speak to your industry contacts. Many of whom still have a jaded view of Cynthia Carroll, I am not sure if it is because she is a woman in what is perceived to be a man's world. I must be honest, I sit in the camp that thinks that she has done "good things" lately.

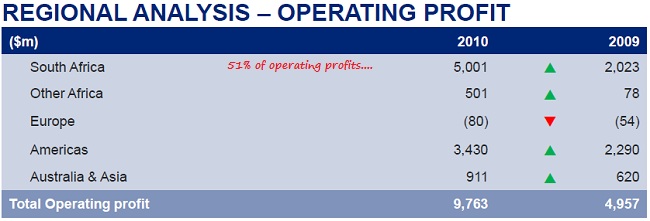

Here is a more detailed look at the results, first some really *nice* slides. Nice is such a horrible word, but it works for the purposes of what I am trying to achieve. First, the question that everyone always asks, how important is South Africa to Anglo American? Here is the answer, very important:

They are still a "South African" company, despite trying to de-South Africanize over the years.

Anglo did well across all divisions other than thermal coal, I have a mate who moves at the end of the week to go and work for Anglo Coal in Queensland. Taking his gum boots no doubt. And luckily he will be based in Brisbane. So he has a new team, the Reds, who squeaked in by a point on Sunday, the least watched game of the weekend. Perhaps, I don't know.

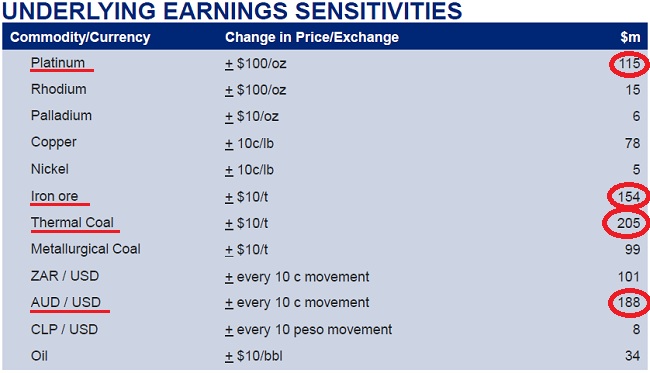

And then this table, completely out of their hands. This makes it a whole lot easier for the mining analysts for their pricing models. Check it out, sensitivities to commodity price moves and currency moves:

You will be surprised to see that the coal assets in Australia are the BIGGEST SWING, in both the local currency to the US Dollar (what all commodities are priced in) and the thermal coal prices. But of course iron ore and platinum prices are just as important. Interesting and informative, if nothing else.

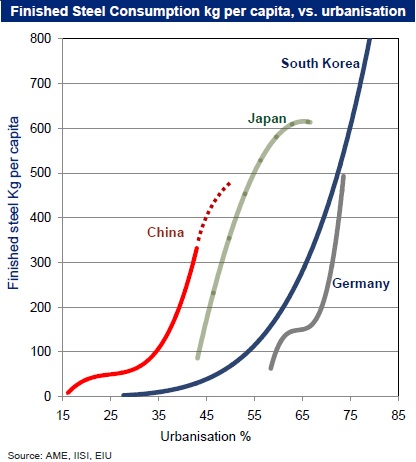

And then perhaps more illuminating and equally unpredictable, the consumption side and why commodity prices are up so much over the last decade. The demand picture. Anglo have a great chart of steel consumption per capita relative to where we are in the cycle of urbanisation. This is very interesting:

The interesting parts are that South Korea, more recently urbanised and industrialised has seen steel consumption per capita go through the roof. Remember that South Korea is a huge manufacturing hub too, something that the Chinese are too. And in time the Chinese could be manufacturers of innovative goods, rather than cheap copy cats. Dr. Martin Davies of Frontier Advisory was on Paul's show last week, and he kind of echoed this sentiment. A senior Chinese government official once said to him tongue in cheek "we are not very clever, but we learn really fast".

On a pricing level all the diversified miners look cheap, really cheap. We still prefer BHP Billiton, it can be argued that their collective assets are better distributed geographically and are much meatier. But these results are encouraging and put the company on a forward basis (as per the analyst predictions) at less than 9 times earnings.