Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

It finally HAPPENED! Wal-Mart have made a bid for Massmart, our favoured retail stock. In the post results interview with CNBC Africa the chief of Massmart Grant Pattison suggested that the premium of a Wal-Mart type bid had been around for the better part of 18 months. Yip. True. And the stock has looked expensive for that long, but hey, don't fight with the market. Here goes the relatively thin on detail SENS announcement:

"Shareholders are advised that the Company has received a non-binding proposal from Wal-Mart Stores, Inc, ('Walmart') which could lead to Walmart making a cash offer to acquire the entire issued share capital of the Company for a price of ZAR148 per share ('the Proposed Offer'). In the event that a firm offer is received the board of directors of Massmart will obtain an independent opinion and express a view on the firm offer to shareholders."

A due diligence will take place and there will be a period of exclusivity. From both parties, suggesting that Wal-Mart were and are looking at other businesses in South Africa, that part is interesting. By my count there are 201.5 million shares in issue. Multiply that by 148 Rands a share and you get to 29.825 billion Rands. So South African shareholders are thrilled. And I say that lightly, because there are many more international shareholders than locals, because, you know, the stock looks expensive to most here. It does not trade at the long term averages, they say. Oh yes, the long term averages back when the 90 percent of the population was denied credit, those long term averages.

Check this bit out from a message that we sent recently to clients after the analysis on Massmart, this part about shareholders and a bid specifically. Here goes, some excerpts from our message on the 10th of September 2010: Is Massmart overvalued at R129 per share?

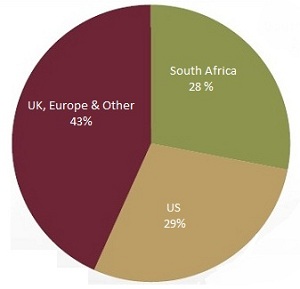

Pie chart of shareholders

CNBC's Stephen Gunnion interviewed the Chief Executive of Massmart, Grant Pattison, last week (back then) on these and other issues. Click here to take a look at the YouTube clip, courtesy of ABN Digital.

In fact, we are not that uncomfortable with the current market valuation, and expect Massmart's earnings to grow into the share price in the year ahead. Here at Vestact we depart from the point that share prices are "right", insofar as they reflect the aggregate view of the current value of the future earnings flows that will accrue to a company's shareholders.