Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Hot on the heels of the BHP Billiton (BIL) production report yesterday is the Anglo American (AGL) Q3 production report this morning. Excellent. And of course at the same time you get Kumba Iron ore (KIO) and Anglo Platinum (AMS) thrown at you too, because they all fall in the same stable. So let us look at the two majority owned entities first, KIO. Nice share code guys, but that sets you up for having to deliver knock out earnings every half.

Kumba produced 10.7 million tonnes of iron ore for the quarter, lower by 5 percent when measured against this time last year. This was largely as a result of decreased production from the DMS plant as "unplanned primary crusher maintenance and the shut-down of the plant due to full finished product stockpiles" That was a little disappointing. Out of their control was the "three separate derailments (that) occurred on the Sishen/Saldanha freight line operated by Transnet." Very exciting is that the traditional markets are coming back: "Demand for Kumba's ore continues to be strong in China and our traditional markets of Japan, Korea and Europe."

And then perhaps the big daddy of all the Anglo assets, Anglo Platinum, some of the highlights include: "Refined platinum ounce production of 697 koz for the quarter, up 11% year on year and 26% quarter on quarter, bringing the year-to-date September to 1.7m ounces" And they remain on track to produce 2.5 million ounces a year and reach their target, this is important, because there were a couple of tough years of production misses, this would be a big boost if they could reach that target.

Productivity is up too, and there is a measure, metres squared per employee per month. And the number is 7. Costs in-line with their targets, as they say: "The year-to-date September 2010 cash operating cost per equivalent refined platinum ounce achieved was R11,647, largely in line with our target despite above inflation increases in wages (up 8.5% since 01 July 2010) and electricity (up 25%). This will be the third year Anglo Platinum keeps unit cost increases to below inflation and largely in line with R11k per ounce." All in all pretty pleasing from Anglo Platinum.

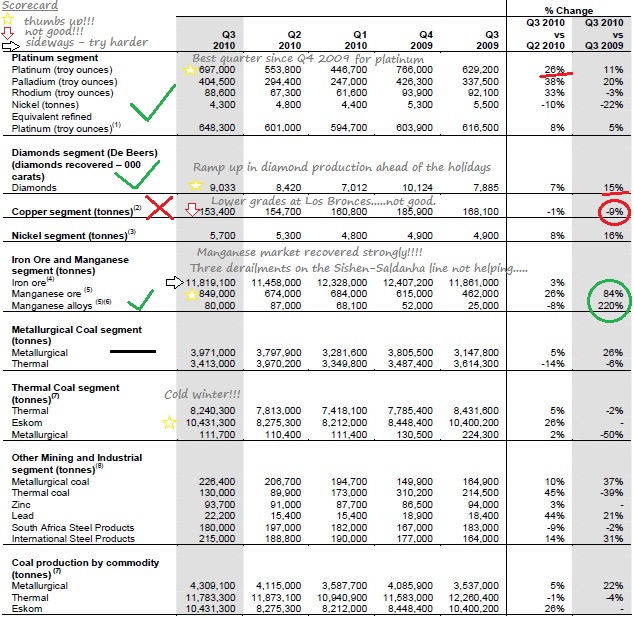

And then Anglo American, the parent company. A picture tells a thousand (hundred, million, billion, trillion in this day and age of throwing around big numbers) words that I could not possibly have time for sadly. So here is the Anglo production report in a table. With scribbles.:

What do you think of my scorecard? Is that about right and fair? And if you had to give a symbol then I guess that a B would be about right. I suspect that many of the management issues that the company had, or the old guard had with the new guard and that was voiced by shareholders might be subsiding. Like Tom Albanese, Cynthia Carroll might well have diverted attention off herself as commodity prices (and volumes) have recovered markedly.