Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Vodacom results hit the screens this morning. This is for the six months to end September 2010. A whole lot of positives here, that is for sure. Nearly 40 million customers, at 39.4 million across the group. Strong growth on the data side, check this out: "Data users increased by 1.2 million in the six month period to reach 7.9 million at 30 September 2010, of which 1.9 million were active data bundle users." We always scoff at the notion that these companies are ex-growth, because of a) the data phenomenon and b) the low base of the average subscriber.

So whilst you will continue to see a trend of more contractual users, they only number 20.1 percent of the overall ZA base, the Average Revenue per user (ARPU) on the post paid will fall naturally. Again, this is where all the growth is going to come from, as users on the subscriber base get better permanent jobs, they can worry less about top ups and buying airtime and become more loyal users. Because in my experience anyhow, it is one thing about talking of moving to another service provider, in practice it rarely happens. What I like a lot is that the international subscriber base is starting to become bigger and bigger.

Let us get into the numbers here. Six months remember. Group revenue up to 26.094 million ZAR, data revenue up 41.1 percent but nearly 11 percent and growing. HEPS at 303 cents per share and interim dividend at 180 cents per share. The stock trades at 6780 cps, and offers good value on simple valuation metrics, if you annualise these numbers. A yield of above five percent historic looks very attractive. This is a sneak preview into the future of the MTN South African business, as Vodacom is not only more mature, but has more cream of the crop subscribers. Getting in first means that you pick up the high end users, which explains why their post paid subscriber ARPU's are better.

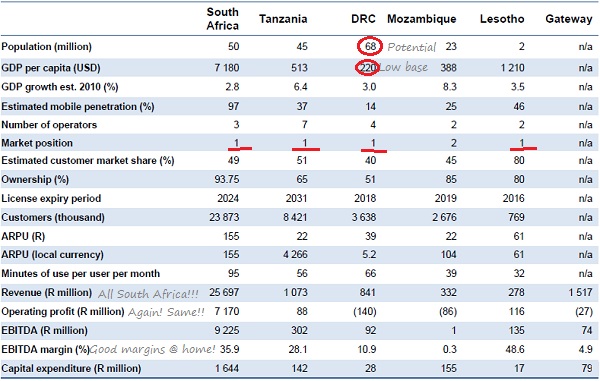

I have inserted a table to make a few points, it is still mostly all about South Africa, but there is huge potential in some of their other geographies.

OK, did you see the circled DRC numbers, the base is low, and subscribers are many? The one thing that worries me about the DRC (for Vodacom, in general everything worries me about the DRC) is its size. So notwithstanding that they are number one in that market, mobile users are low. I tell you, if the DRC can "crack it" and evolve in much the same way Nigeria did over a thirty year period, Vodacom would be well placed.

Gateway revenues are flat, year on year in Rand terms, up 10.3 percent in Dollar terms. Gateway contributes around 40 percent to their international segment revenues and will be key in cracking the Nigerian market. Just participating is my mind is key, look at Telkom, notwithstanding their poor execution, the fact that their operations are in this lucrative market has helped them. Perhaps there is more detail on Gateway at the presentation a little later this morning, but there were only five references to it. In the pack, which I downloaded here ---> Interim results - for the six months ended 30 September 2010 there is little reference to Gateway again.

In short, I like it a lot, Vodacom, but much prefer MTN. I think that the geographical shackles of parent Vodafone thrown on during the early days were a net benefit for MTN, who went foraging far and wide. I do think that the general consensus that these companies are ex-growth is nonsense. You are going to do more and more on your handset, not less. Hey, DSTV just launched a mini portable decoder that you can connect to your iPad and laptop. That connects through the mobile networks. The new "thing" is the portable decoder. Fair analysis on Vodacom, or not?

Just to put it into perspective, this company is not yet able to drive or to partake in a tipple or two (17 years old) but yet it has a bigger market capitalisation than ABSA, which was founded in 1986 in the current form. And nearly three times the size of Tiger Brands, which was founded in 1921 and listed first in 1944. Whoa!