Vodafone (parent company of Vodacom) have raised their full year guidance and their outlook, what a twist. The stock is trading a percent and a quarter higher this morning. What struck me immediately is that their share from Verizon wireless is a little less than 40 percent of overall profits. Whoa!! As we threw this number around the office we suspect that in the long run, when Vodafone need the money, they could look for a buyer. Verizon wireless has 93 million customers. With monthly ARPU's of 53.4 US Dollars, that is actually down from 54.6 Dollars last year.

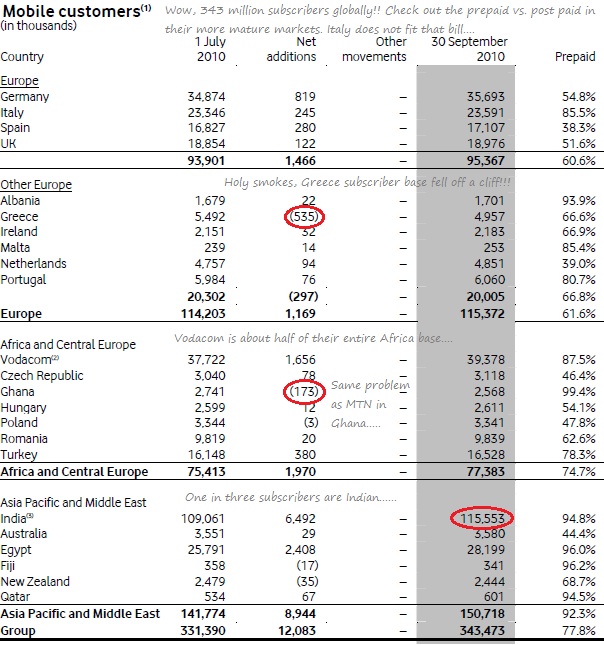

Check out their astonishing subscriber base:

These guys were "early" and overpaid for some assets that were perhaps a little more mature than it turned out. Their all time high was when tech stocks were valued at Buzz Lightyear valuations ("to infinity and beyond") back in March 2000, at around 440 pence. Today they hang around at 177.7 pence a share. You could have bought them at these levels nine years ago. So, price wise they have done "nothing". They make 16 pence a share and pay half of that in dividends, 8 pence. A four and a half percent yield in a European context sounds positively fabulous. Perhaps another chapter in their history, I quite like them at these levels.