Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Cisco. The disco went wonky last night post the market, as Cisco reported first quarter numbers, that were decent enough, but fell short of analyst expectations and the outlook disappointed. The stock is down 12 and a half percent in after hours trade, I guess that is all you need to know about the disappointment levels of the participants. The conference call saw the Cisco team take some pretty hard questions and respond with a "oh, it's the economy" and not saying that it was a Cisco thing, which is probably what analysts listening in wanted to hear. I mean, why not, it seems as if the economy is improving?

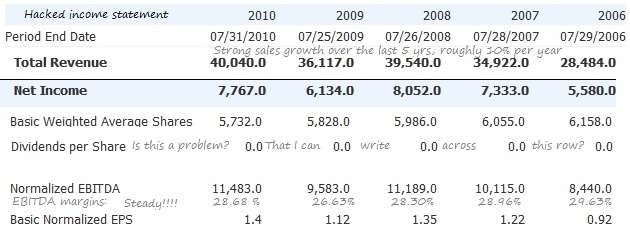

Well, I guess if Q1 revenue was better by 19 percent when compared to Q1 2009, and net income better by 8 percent, earnings per share better by 13.3 percent to 34 US cents. Annualise that and you get to 136 cents. Not too expensive I guess, by global standards. I think the biggest problem is that this indicates that earnings for the present full year are going to be equal to last year and equal to two years ago, and perhaps investors are getting a little impatient. They ought not to, I hacked their income statement and scribbled on it, EBIDTA margins maintained over the last five years, even as group revenue has grown strongly:

No dividend either to appease shareholders with, I am starting think that although the big share buybacks are compelling and might be a better utilisation of cash, there are some big tech companies that must be thinking about paying a dividend. Cash and cash equivalents of nearly 39 billion Dollars should be leaving shareholders feeling a little itchy. John Chambers puts on his usual cheerful self: "Our position in the market, including continued product innovation, market share momentum and operational excellence, positions us for growth and flexibility well into the future as we strengthen our role as a trusted business partner to our customers."

We like it, the company the product, the fact that they (Cisco) will continue to be the canals of the internet. We would use this sell off as another opportunity to add to either your existing positions or to add a new position in our view is a quality performer.