Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

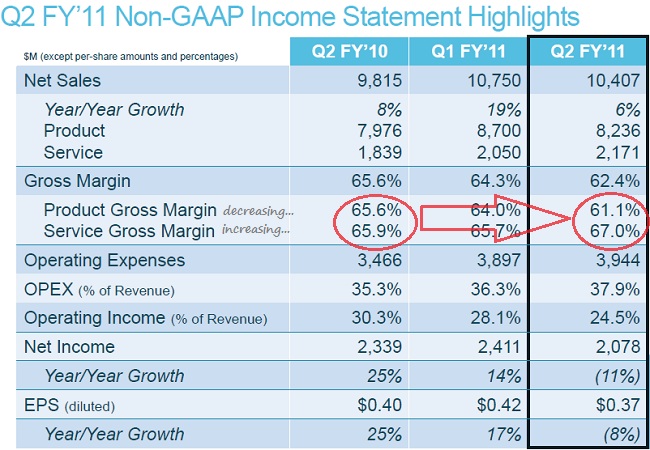

Another one of our recommended stocks in New York, Cisco, reported after hours. And another disappointment, not because of an earnings or revenue miss, they beat on both scores for the quarter, but rather it was the margin squeeze on the go, as a direct result of diversification. But really, sending the stock down nearly nine percent in after hours trade seems like an over-reaction. Gross margins were anticipated to be 63.3 percent, instead it came at 62.4 percent. As Paul pointed out, there was a lot of hot money that flowed into the stock prior to the results (anticipating a blowout quarter) and those fellows are probably closing those positions out in a hurry. Here we go, sales across the divisions.

We like the sector a lot, but Cisco are under a little bit of pressure here with Juniper and HP and "the cloud" eating their breakfast. I think that these might just be leads and lags of sorts, the more users, the bigger the internet, the more routing and switching is required, the greater Cisco's global sales will be. Check what John Chambers (try your Southern drawl while reading) said in the conference call that the fellows over at Seeking Alpha have so beautifully put together ---> Cisco Systems' CEO Discusses Q2 2011 Results - Earnings Call Transcript:

"I'm extremely comfortable with our product leadership and architectural competitiveness of the new switching product versus our peers. And we are moving very aggressively to protecting the erosion of our future market share from a port or revenue perspective."

Cisco Emerging market sales grew 27 percent in Q2 2011, versus the comparable period. Gross margins in the same regions were lower than they were across the other geographies. Still, the margins are eye popping. But costs are rising too. And of all that cash they have (40 bn USD), less than ten percent of it is in the US. And that is why there won't be any meaningful dividend, the tax authorities in the US would gobble it all up if Cisco brought the war chest back home. Frank Calderoni, the CFO from the aforementioned transcript of the conference call, thanks Seeking Alpha:

"As we have previously announced, we plan to issue a dividend during fiscal 2011 with the yield in the 1% to 2% range." YAY....but hardly a big move. Baby step on the dividend. The numbers, check out the income statement:

Chambers thinks that the company can get back their mojo and win in two thirds of their top product offerings quarter by quarter, he suggests that is a good strike rate, if I can use a cricket analogy. Read the Q&A segment after the conference call presentation by John Chambers. Almost all the questions relate to the margins issues. Whilst I would say that it is tiresome to keep seeing the stock fall back after results, these results are definitely not poor. Guidance for Q3 is for 4 to 6 percent revenue growth. For the full year revenue growth is expected to be between 9 to 12 percent. Provided they can maintain margins and get back a little, that would be a good outcome, somewhere near 1.55 USD to 1.60 USD worth of earnings for the year. And 20 cents worth of dividends. Let us just say that the stock is under review.