Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

African Bank out with their full year results this morning. There was a slide that captured my attention in the presentation, check this out, because it sums up the operating environment as well as their experience

The group makes a point, like quite a few out there, that the second half was much better than the first half. Which is out of the ordinary, because traditionally the first half is better than the second half. But as ABIL point out in their presentation, headline earnings for the second half was 11 percent better than the first half. "Economic profit" was 20 percent better on the same measure.

Diving straight into the numbers, the dividend for the full year is a dead ringer of that of last year, including the final of 100 cents, taking the full year payout to 185 cents. Around an 80 percent payout ratio, so you can work forward to 235 cents per share worth of earnings, or 1.890 billion Rands worth of earnings for the full year. Which is a four percent increase on last year's numbers. Bad debts to advances decreased for the first time in three years, to 9.9 percent of total advances. More impressively, costs-to-advances has plunged over the last five years to 6.4 percent. Versus 15.4 percent in 2005, that shows you how serious the group are about costs. They always have been, you know, something they stress at each and every results presentation.

In the African Bank business unit, gross advances increased by 20 percent to 24.2 billion Rands. The credit card book is growing handsomely too, the credit card portfolio now stands at 2.9 billion Rands (up 56 percent) with a total of 500 thousand card holders. Awesome, that is the long term thinking is my sense here, it seems a lot more mature way of doing their type of business. Well, that is the way that I see it.

The Ellerines side of the business saw sales up 7 percent (4.487 bn ZAR) but headline earnings up a whopping 35 percent. There was quite a big turnaround in their retail business as a result of a marked improvement in credit sales, which were up 15 percent whilst cash sales fell 3 percent. Wetherlys sales fell a whopping 18 percent, whilst Geen & Richards increased 17 percent and Beares (who really cares) saw sales increase 16 percent. Margins are ticking up and costs are going down. Plus the new loans being extended are cheaper, longer in term and larger in size. And better quality.

Now there is a line item on their income statement that shareholders will be pleased with, operating costs, that is lower by two percent when compared to last year. Although next year we can see a "modest" rise in operating costs, not too bad though. Wow, bond issuance and long-term funding has increased 42 percent to nearly 21 billion Rands. And the cost of funding more importantly has improved by 100 basis points. Excellent, sounds like a good outcome to me.

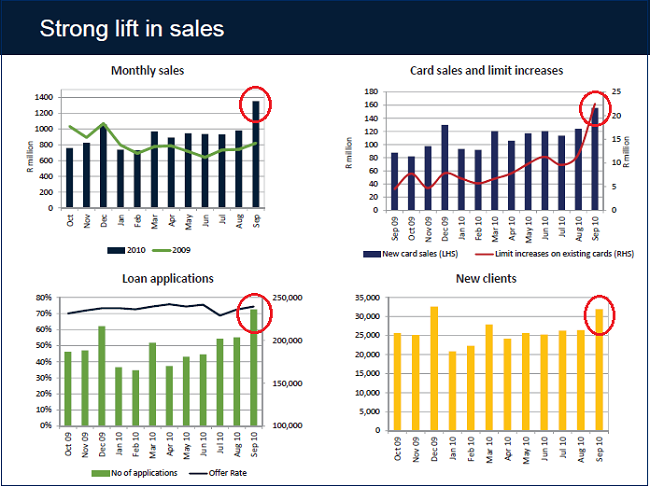

There is a lot of anecdotal evidence that "things" are improving. There is even visual evidence, I have circled the September numbers on the strong lift in sales slide to make the point:

And in fact the outlook is a little better, even if not too exiting: "Whilst economic conditions are expected to remain challenging, we do expect some improvement during the next financial year as lower inflation and interest rates start to stimulate consumer spending. For African Bank, the recent lift in sales bodes well for the 2011 financial year." The stock has turned lower by 1 and three quarters of a percent, telling you that participants are slightly disappointed.