Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

By far and away the biggest news (I think) was a government press release, and only the second half really. And it had to do with this Statement on Cabinet meeting of 24 November 2010. So what I hear you say, hold on a second, this piece, which itself would you believe was highlighted and published in bold itself. Here goes:

"Sounds like a good outcome for the consumers of steel. And by extension the construction companies and the mining companies (remember the spat with the gold miners and Arcelor Mittal).

Does not sound like a great outcome for Arcelor Mittal, or Imperial Crown Mining for that matter, because it sounds like that "chip" has reverted to government. But it is a prospecting right. What does that mean for the pending empowerment deal over at Mittal? Is in not valid then? Phew.

Complicated. How would this cabinet sub-committee use their political leverage over the DMR to reverse the earlier decision of the granting of the prospecting right at Sishen, as per the investigative process at the DMR?

At the bottom end of who this is not good for, I would think that Kumba Iron ore would revert back to their old agreements." In other words the better pricing that they have in place now would revert back to this cost plus three percent iron ore pricing. "And Arcelor Mittal would not see the old benefits. And by extension the biggest shareholder in Kumba, Anglo American." Anglo American hold a little less than 63 percent in Kumba Iron Ore, which in turn owns 75.1 percent of the Sishen Iron Ore company. Kumba Iron Ore now exports 85 percent of all of their iron ore production (2009) "And a modest negative to Exxaro." They (Exxaro) own 20 percent of the Sishen Iron Ore company "

Confusing, still, this needs to be rubber stamped by government."

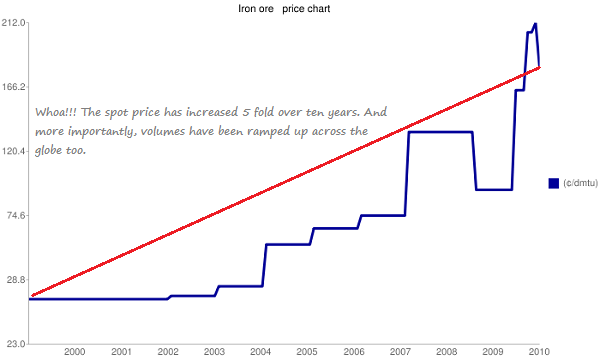

I want to make a couple of points here. When the preferential agreement was in place in the unbundling process at the beginning of last decade, both iron ore spot prices were much lower AND Iscor (Iscor Ispat, Arcelor Mittal, all the same thing) was a much more important customer of Kumba Resources (the predecessor to Exxaro and Kumba Iron Ore). The mix starts to change drastically as Chinese steel consumption ramps up sharply.

I dredged up the pre listing document dated end of September 2001 for Kumba Resources (which split from Iscor) and later split into what we know now as Exxaro and Kumba Iron Ore, and was surprised by the production number on the iron ore side: "The iron ore SBU currently operates two iron ore mines. In the financial year ended 30 June 2001, the Sishen and Thabazimbi mines produced 27,0 million tonnes of iron ore and contributed R3,3 billion to Kumba's revenue." Wow. That is more than I thought.

In the initial listing statement there was a supply agreement over the 6.25 million tonnes per annum. But remember that Iscor shareholders also got a great economic benefit: "Kumba shares would be distributed to Iscor shareholders pro rata to their

existing holdings".

Anglo American made an offer to minorities (after having hoovered up 35 percent, which was bought from Benny Steinmetz and Avmin), that opened in November 2003, for wait for it ......... 37 Rands a share. Government apposed this publicly and Anglo were only able to mop up less than two thirds, less than they would have liked, more than government wanted. All the while, a year earlier to that, the Mittal family had been buying Iscor shares as it was then, and had in the bag a little less than 35 percent at the end of 2002. Early 2003 (end of Feb), Mittal upped their stake with a partial offer to minorities, ratcheting their stake up to 47 percent.

The point that I often make with this Sishen Iron Ore agreement is that there were at the time (September 2001) no majority shareholders in either entity. In fact both of the controlling parties had nothing to do with the initial agreement. I honestly don't blame Kumba Iron Ore for not "spotting" Arcelor Mittal when it came time to renewal.

A little later in the day yesterday, I emailed the Kumba Iron Ore investor relations person, someone who actually works for Brunswick. And her reply to me was the official one from Kumba Iron Ore, and I hate to overload you with details, but here goes:

"Kumba Iron Ore ("Kumba") has taken note of the Cabinet meeting statement dated 24 November 2010 and remains committed to engage with the IDTT in discussions regarding the iron ore and steel sectors. The discussions held with the DTI to date have been preparatory in nature, and have not yet enabled the company to fully engage with all the members of the IDTT, and other relevant stakeholders.

Numerous issues still need to be extensively discussed between the IDTT and Kumba, before any concrete proposals can be considered. An appreciation of all the relevant factors involved in the entire iron ore and steel value chain is critical to these discussions. Kumba believes that it is premature in the circumstances to come to any firm conclusions as to the optimal way forward.

A further key consideration to bear in mind is that Kumba is currently engaged in two material litigation matters, which are directly relevant to the issues noted by Cabinet.

The two legal matters are firstly, the private commercial arbitration proceedings currently underway between AMSA and Kumba (both independent companies listed on the JSE) which are designed to provide clarity on the respective obligations between the parties.

The arbitrators are required to determine whether or not AMSA has retained the legal entitlement to receive up to 6.25mtpa from the Sishen mine at cost plus 3% following AMSA's failure to convert its mineral rights and the subsequent lapsing of the supply contract with SIOC. This process must be finalised between the parties, in order that clarity may be provided on the mutual rights and obligations of the respective parties going forward. Kumba is committed to this process, and remains confident of its prospects of success in this arbitration.

The second legal process is the pending High Court review process currently underway, in which Kumba seeks the setting aside of the 21.4% undivided prospecting rights granted to Imperial Crown Trading 289 (Pty) Ltd, and the granting of the residual 21.4% undivided mining rights to Kumba. The matter is currently before the High Court, and Kumba believes that this process should be completed as expeditiously as possible, in order for the Court to pronounce on the rights and obligations of the respective parties, as well as the correct interpretation of the MPRDA.

As a result of the premature nature of the discussions between Kumba and the IDTT, as well as the legal matters currently underway, it is therefore not possible for Kumba to enter into any agreements before these processes have been concluded."

I guess in the eyes of Kumba this announcement is a sideshow to the real issues. Either way I think it is not a great outcome to be wrestling with government, and that applies to Anglo as the majority shareholder too. And Exxaro. And it is not a good outcome for Arcelor Mittal either. And perhaps the party to come out worst affected would be Imperial Crown Trading. I would think. What DO YOU think of all these complicated events?

Ye olde world. Protests in Greece yesterday, folks marching, carrying banners, not at work. Or perhaps they are unemployed, I shouldn't be so callous and rude. But stay tuned guys, because I suspect the bond vigilantes have done more than enough for us to be talking about a Portuguese debt aid package in the coming weeks. The truth is not whether they need it, perhaps they do and perhaps they are talking about it (the Portuguese government have denied any such talks), but rather whether the perception is that they need it. Because bond investors in Portuguese debt are asking those questions right now. And my experience is that they would sell first and ask questions later. And once the longer dated bonds are yielding more (double a year ago at 7 percent on the 10 year now), and have been sold off. It is then too late.