African Bank with quite a wow trading statement this morning. Even then though, they are pretty cautious. Check it out chaps (and chappesses): "ABIL indicated in its annual results announcement for the twelve months to September 2010 that it had achieved a significant increase in credit sales in the second half of the 2010 financial year, which represented growth of 33% over the prior year`s comparable period."

From the write up that I did a couple of weeks ago:

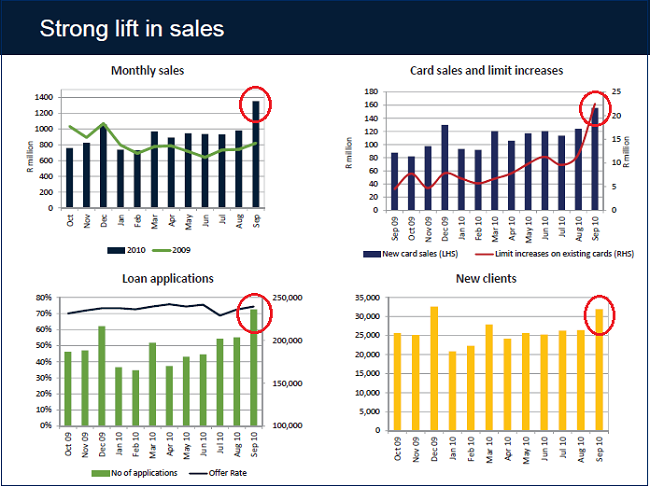

There is a lot of anecdotal evidence that "things" are improving. There is even visual evidence, I have circled the September numbers on the strong lift in sales slide to make the point:

Check that sales mix, September was a good month. It seems that things are getting a whole lot better, judging from this "While some seasonal growth is to be expected over the traditional peak trading period, group credit sales for October 2010 and November 2010 increased by some 60% over the prior year's comparable period. The growth in credit sales has been driven largely by a significant increase in application volumes, including strong growth in new clients." The stock is up more than three and a half percent and is trading at and near all time highs. Granted that 37 was first crested in November 2007.