Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

BHP Billiton released their half year (and second quarter) production report this morning. And of course there will be anxieties about their coal production in Queensland, so here goes the official line from the company: "Queensland Coal (Australia) production was significantly affected by the persistent rain and flooding that impacted the Bowen Basin during the period. In the December 2010 quarter, Queensland Coal production declined by 30% when compared with the September 2010 quarter, while sales declined by 15%."

"The decision to increase pumping and drainage capacity following severe wet weather in the March 2008 quarter has minimised inpit water accumulation, although heavy rainfall that persisted for much of the December 2010 half year has significantly restricted overburden removal. When combined with disruption to external infrastructure, we expect an ongoing impact on production, sales and unit costs for the remainder of the 2011 financial year."

And of course that is where the focus is this morning, not getting excited about this: "Record iron ore production and shipments were achieved for both the half year and quarter. Western Australia Iron Ore shipments rose to an annualised rate of 148 million tonnes per annum in the quarter (100% basis)."

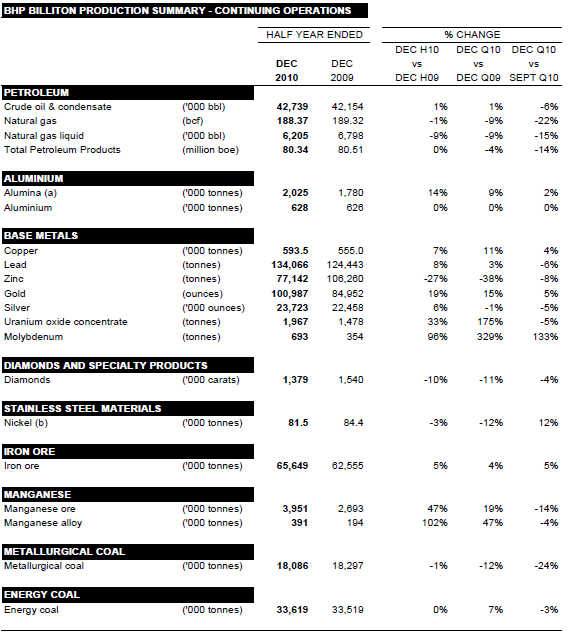

Check out the hacked production report.

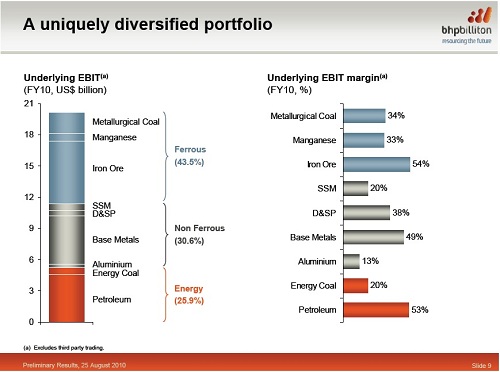

But then I am going to show you something much more interesting, the three big drivers for BHP Billiton, Petroleum, Base Metals and Iron Ore. So you should worry a little more about the lower Petroleum division output, over the Coal division in Queensland. Someone please tell the newswires. Check out the EBIDTA margins at these divisions specifically.

See what I mean?