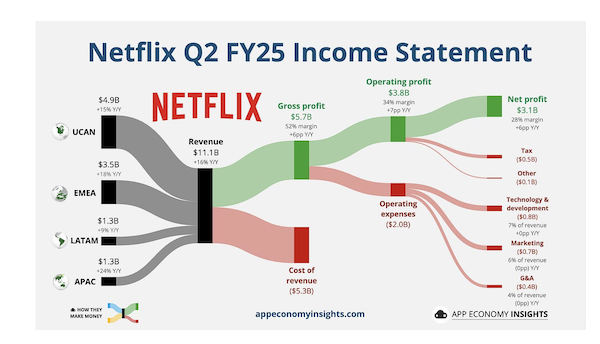

Netflix reported solid numbers last week. They beat analyst estimates across the board, although most of that came from a weaker USD. Revenues grew by 16% with operating margins of 34%. Guidance for the rest of the year suggests they can maintain that 16% growth rate.

The company no longer reports subscriber numbers. The business has grown up now and is focusing on adult metrics such as cash flows and revenues. Speaking of which, free cash flows for the quarter were $2.3 billion of which $1.7 billion will be used for paying down debt and share buybacks.

Advertising is officially live in all its regions and is doing very well. 50% of new subs choose the cheaper advertising option. As users watch more shows, the algorithms pick up their likes and dislikes and feed them targeted adverts accordingly.

Have you seen the new homepage? Probably not as things take a bit of time to get to the bottom of Africa. It has been rolled out to 50% of their users and is apparently outperforming all engagement expectations.

Netflix is a mature business, spitting out cash and buying back shares. That's just fine; it's nice to see your children grow up into mature adults, adding value to society. We've held this one since they were still renting out DVDs and remain happy holders of this quality business.