Market scorecard

US markets were shut for Presidents' Day yesterday, making it very quiet in the Vestact office. The results from Walmart and Home Depot today, and Nvidia tomorrow will set the tone of the market for the rest of the month.

In company news, BHP Group reported profits that came in below expectations but said that demand in China was healthy, even with the weakness in the housing sector. Elsewhere in Tokyo, SoftBank's founder Masayoshi Son is said to be creating a $100 billion fund to focus on chip manufacturing linked to the AI sector.

Yesterday, the

JSE All-share closed down a tiny 0.05%, the

S&P 500 fell 0.48%, and the

Nasdaq was 0.82% lower.

Our 10c worth

One thing, from Paul

Some people think that tech stocks are overvalued and about to get their comeuppance. They say things like "It's a bubble and it's about to burst", or "What goes up must come down" or "Trees don't grow to the sky."

Actually,

tech stocks have gone up because the companies themselves made much higher profits. In other words, their earnings have risen in tandem with their share prices. Regular readers of this newsletter won't be surprised, Byron has written about this issue many times.

Drew Dickson of Albert Bridge Capital (that's him pictured below)

wrote a blog post in which he notes: "

Nvidia now has a $1.7 trillion market cap. And in the last five years, the stock is up about 1 700%. Guess what else is up about 1 700%? Nvidia's earnings estimates."

He continues: "Look at

Google over the past 14 years (earnings up 885%, stock up 980%); or

Amazon during the same period (earnings up nearly 2 500%, stock up about 2 800%). Analyse

Microsoft over the past 22 years. Forward earnings projections have increased from $0.93 in February of 2002 to $11.57 today. That's nearly 1 150%. The stock is up just over 1 200%."

Byron's beats

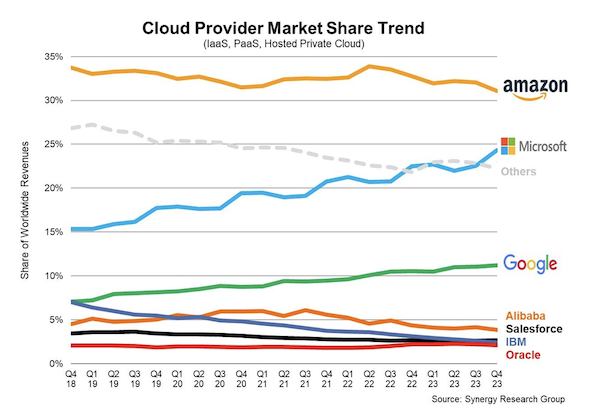

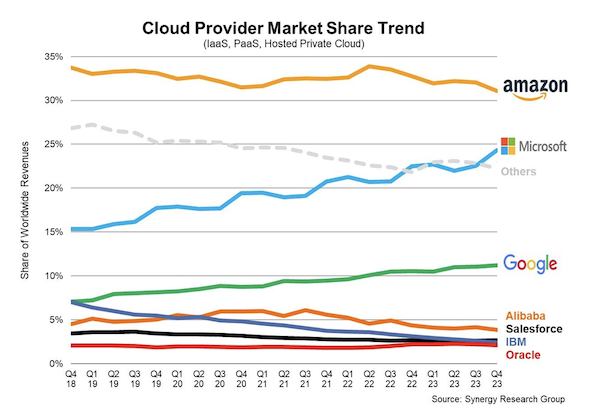

Cloud services have been growing incredibly fast over the last decade or so.

Now that all the big players have released their quarterly results, we can take a closer look at who is dominating the sector.

As you can see from the image below, there are three major players, making up 67% of the market - Amazon (AWS), Microsoft (Azure) and Google (Google Cloud). They all did very well in a sector that was estimated to grow 18% during the period, but Microsoft can hold its head up high as the best performer.

Azure grew revenues by 28%, resulting in a solid market share gain. As you can see from the graph, it looks like AWS was the loser in the quarter, only growing by 13%. Nonetheless, AWS is still the market leader, and growth becomes more difficult with size.

We are very happy to be exposed to the cloud services sector through these behemoths and hope they all do well.

Michael's musings

I enjoyed this blog post,

The most overrated things in personal finance. It is written by Nick Maggiulli from the blog 'Of dollars and data'.

His list includes the idea of early retirement, and owning investment properties.

Interestingly, in my experience, I haven't come across many people who talk about the desire to retire early. The FIRE (financial independence, retire early) movement hasn't really taken off here. Maybe it has something to do with how South Africans are wired?

Don't confuse financial independence with retiring early though. I think the goal for everyone needs to be financial independence, but you can be independent and still work.

It seems that most people I speak to want to own an investment property.

For some reason, there is this idea that you haven't arrived as an investor unless you have an extra property generating rent. I agree with Nick, most people underestimate the effort required and overestimate the income they think it will generate. Not to mention South Africa's tenant-friendly laws.

My personal finance advice is to strive for financial independence and to keep your investment journey simple.

Bright's banter

Capital One has announced its acquisition of Discover Financial Services for over $35 billion in an all-stock deal. This move aims to merge two major credit card companies in the US and capitalise on the growing credit card sector.

The tie-up provides Capital One with access to Discover's extensive network, enhancing its position in the payments ecosystem and expanding its customer base, particularly among high-credit-score cardholders.

Overall, the deal reflects Capital One's commitment to strengthening its presence in the financial services industry and capitalising on evolving consumer trends in digital commerce and rewards programs.

Linkfest, lap it up

Linkfest, lap it up

NASA teamed up with the private sector to land on the moon again. Apart from NASA's scientific tests, there is also fabric from Columbia Sportswear -

Private Odysseus lunar lander heads for the moon after SpaceX launch.

Intellectually, we know small differences matter. However, when it comes to compounding it's much harder to understand -

On the power of small differences.

Signing off

Asian markets are in the red this morning. Benchmarks retreated in India, Hong Kong, Japan, mainland China and South Korea. These moves came after Chinese authorities announced a record reduction in a key reference rate for mortgages, signaling heightened efforts to bolster the property sector and stimulate demand.

The Rand is trading around R18.98 to the US Dollar.

Today we will see earnings reports from Walmart, Home Depot, Palo Alto Networks, and Medtronic.

Sent to you by Team Vestact.