Market scorecard

US markets continued to march higher yesterday. The rally was broad with banks and energy companies leading the gains, the latter aided by a rise in oil prices. The winners were Wells Fargo (+7.2%), Tesla (+6.2%), and Chevron (+3.4%), while the losers included Deere & Co. (-5.2%), Adobe (-2.4%), and Google (-2.2%).

In company news, semiconductor equipment maker Applied Materials is up 12% after hours thanks to a bullish sales forecast for 2024. Elsewhere, Cisco fell 2.4% because the networking company gave a cautious revenue outlook, and announced widespread job cuts.

In summary, the

JSE All-share closed up 0.28%, the

S&P 500 rose 0.58%, and the

Nasdaq was another 0.30% higher.

Our 10c worth

One thing, from Paul

Friday again? Here's some more life advice from me: be more patient.

Everything worthwhile takes longer than you think it's going to take. That includes investing, building a business, raising children, renovating a home or getting in shape.

Or in my case recently, launching a new Vestact website. The project started in August 2023. Yikes!

Here's Ryan Holiday on the topic: "That's life. That's how success works. It probably takes longer than you're willing to wait. In any case, it takes however long it takes. We want our progress now. We want our success now. We want our rewards now. But if you can practice delayed gratification, if you can understand that all good things take time, that it's a process, you're almost always going to be more successful."

Byron's beats

We often talk about how the stocks we own are safe investments. The shares might be volatile at times but the underlying businesses are in great financial shape.

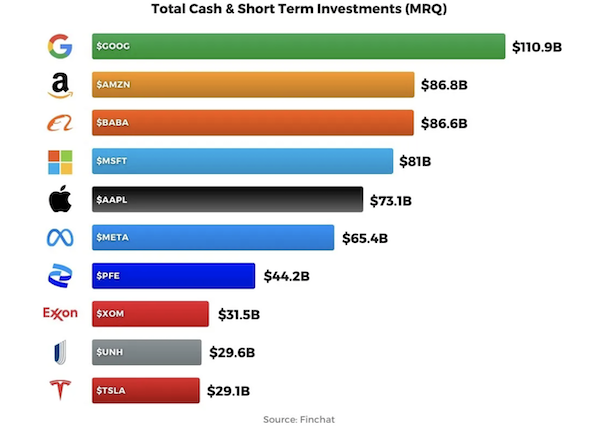

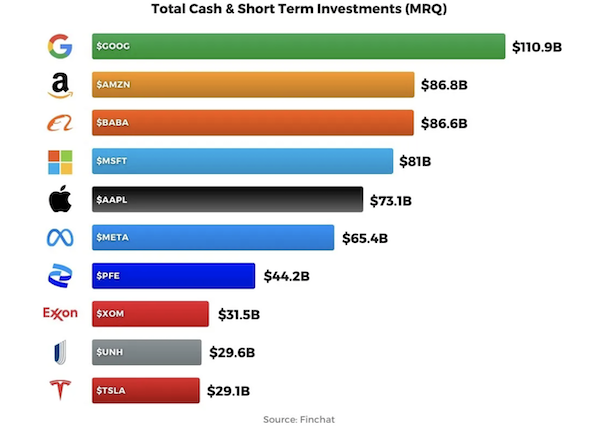

The below image shows the top 10 companies listed in the US in order of cash on their balance sheet.

Six out of the ten are Vestact-recommended portfolio stocks. You might be surprised to see Tesla on the list. That business has come a very long way from being a mere concept a decade ago.

When I analyse a company's balance sheet, I always look at their level of cash and short-term investments (usually bonds that offer some yield but are easily sellable).

Being liquid gives companies a lot of flexibility. They have a backstop when times get tough, they can make quick acquisitions if an opportunity presents itself or they can buy back their own shares and/or pay dividends.

Michael's musings

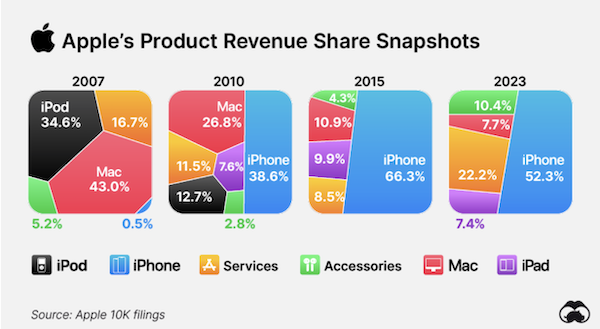

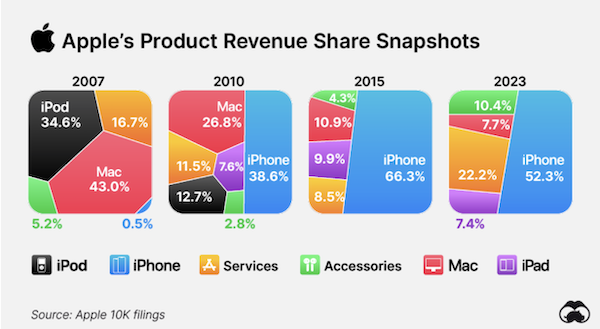

We've often written about Apple's evolving product mix,

this graphic from Visual Capitalist, shows how that has changed since 2007.

It's amazing how Apple has been able to reinvent itself over the years.

Another thing to note is the scale of the company. Even the iPad, which is fading off into obscurity, has had more sales in one year than the entire market cap of the FirstRand group - $28 billion vs. $19 billion.

Lastly, you can see the growing significance of services and accessories. Apple has done really well to tap its network of over 2 billion devices to get these 'small' bolt-on sales.

It is not too hard to imagine a day when services are a larger part of the business than all of the hardware. Picture customers buying an Apple device to get access to Apple's AI technology.

Bright's banter

Uber results out last week showed that it's reached a significant milestone - its first full-year operating profit since listing nearly five years ago.

The fourth-quarter operating income of $652 million comfortably exceeded forecasts. Additionally,

Uber reported a net profit of $1.9 billion for 2023, compared to a staggering $9.1 billion loss in 2022. The success can be attributed to strong demand for ride-hailing and food deliveries, along with its burgeoning advertising business.

Uber's journey to profitability has been arduous, marked by steep losses and scepticism about its business model. However, as the world emerged from the Covid-19 pandemic, the company capitalised on thinner competition and cost-cutting measures.

They've announced a $7 billion share buyback, underscoring their newfound financial strength. This was very well received by the markets (+15% on the day).

Looking ahead, Uber expects gross bookings to rise to as much as $38.5 billion.

They now have 150 million monthly active users.

Uber shares are up 125% in the past year to $81.39, racing past its IPO price of $45. The company is in good hands under the current management team.

Linkfest, lap it up

Linkfest, lap it up

What time of day should you workout? Morning or evening, here's what experts had to say -

Well, it depends.

Nuclear fusion has always been just around the corner. Progress has been slow but we are getting closer -

Clean energy machine generates record levels of heat.

Signing off

Asian markets are mostly higher this morning. Benchmarks gained in India, Hong Kong, Japan, and South Korea. The Japanese Nikkei 225 is crawling closer to its historic high reached in 1989 notwithstanding that its economy just went into a recession.

US equity futures are unchanged pre-market. The Rand has picked itself up and is trading just below R19 to the US Dollar.

Next week a few more interesting companies will be reporting their latest quarterly earnings, including Nvidia, Walmart, Home Depot, Booking Holdings, Block, Moderna, and Berkshire Hathaway.

Have a great weekend.

Sent to you by Team Vestact.