Market scorecard

US markets had a strong session yesterday, retracing losses from Tuesday. The S&P 500 closed above 5 000 points again. Nvidia rose another 2.5% to overtake Google as the third-largest listed company in New York, with a market capitalisation of $1.825 trillion.

In other company news, ride-hailing giant Uber soared 15% after announcing a $7 billion share buyback. Discount broker Robinhood tacked on 13% as revenue topped estimates. Lastly, Lyft was up 60% pre-market but (only) closed up 35% following an embarrassing snafu in its earnings release, which contained an extra zero in the 2024 margin estimate. Locally, Transaction Capital plans to raise up to R1.25 billion by unbundling and listing WeBuyCars.

In summary, the

JSE All-share closed down a tiny 0.07%, but the

S&P 500 rose by 0.96%, and the

Nasdaq flew 1.30% higher.

Our 10c worth

Byron's beats

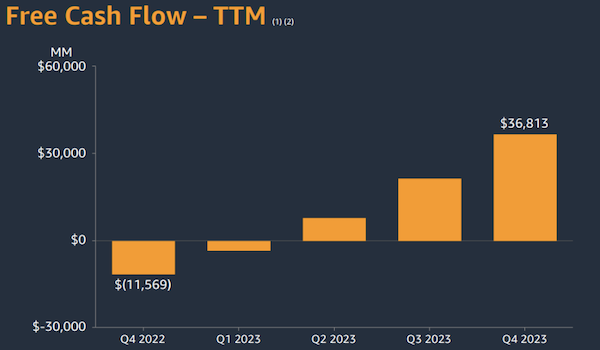

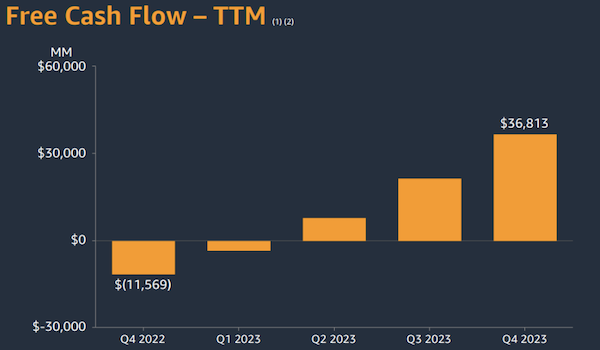

For over a decade, Amazon was the odd one out when it came to profit margins amongst the big tech giants. Online retail is a high volume, low-margin business and Amazon could not compete with the software leaders when it came to free cash flow generation. But that has started to change. Take a look at the image below, showing the massive surge in cash flow that is underway at Amazon.

Ironically, much of that upside comes from a business that is only possible because of their online retail store, and

that is advertising. Although it's now only 9% of sales, advertising most likely contributed a large amount to these free cash flows due to its high margins.

Of course, AWS has been holding the fort for a while now when it comes to providing Amazon with large doses of cash. But now there are two stalwarts, and it's making a big positive difference to the company's finances.

One thing, from Paul

Dictionary.com just added a bunch of new words for 2024. This is how culture advances, and I love it! Here are some of the new ones that are going viral.

Contemporary topics: greedflation, climate breakdown, intimate partner violence, bagholder.

Odd behaviour: skiplagging, bed rotting, enshittification, range anxiety, girl dinner.

Health and wellness: prebiotic, keto flu.

Fashion and aesthetics: eco-chic, Barbiecore, shackets.

Random bonus category: energy poverty, sound bath, boobne.

Michael's musings

The Daily Maverick is running a series of articles about our upcoming elections.

Yesterday they provided a summary of the EFF's election manifesto, which, as expected, is based on populist ideas. They throw out fun suggestions like doubling all social grants and introducing a monthly payment of R5 000 to unemployed students. These plans are designed to resonate with the many unemployed voters in South Africa.

Another of the EFF's core policies is the nationalisation of banks and mines, without compensation. They seem to think that the banks and mines are owned by a handful of people from Stellenbosch, aka "white monopoly capital". In the mind of the EFF policy commissars, taking these assets from them won't matter.

That isn't the case. Large, listed corporates in South Africa are mostly owned by the middle classes through pension funds, so taking them without compensation will gut the life savings of ordinary citizens. Standard Bank also has the Industrial and Commercial Bank of China (ICBC) as a 20% shareholder. I suspect the Chinese won't be too happy seeing their investment nationalised.

It's very unlikely that the EFF will come to power or that their wild economic ideas will come to fruition. However, their ideas may gain traction over time which is another reason to invest in international companies over those listed locally.

Bright's banter

Airbnb reported decent numbers in their latest quarter results, with strong travel demand despite concerns over festering geopolitical conflicts. Revenues rose to $2.22 billion, a 17% increase from the previous year. Gross bookings value also surged 15% to $15.5 billion, surpassing Wall Street's forecasts.

They reported a net loss of $349 million, attributed partly to a $1 billion charge related to tax withholding expenses and lodging tax reserves, mostly in Italy. Excluding these adjustments, the company reported a net income of $489 million.

Long-term stays of 28 days or more continued to rise, and trips lasting three months or longer increased nearly 20% compared to the previous year.

This pushed number of nights and experiences booked by 12% to a record 98.8 million.

Airbnb's board authorised a $6 billion share buyback program, signalling confidence in the company's future growth prospects, but their shares declined 1.7% yesterday. The stock price is flat since listing in 2020, it's been a long hard road for the Airbnb team.

Linkfest, lap it up

Linkfest, lap it up

Dementia is a terrible disease. The scientific community is ploughing billions into finding ways to detect and treat it -

Biological markers identified in early blood tests.

AI is making rapid advances. But there are some things that humans do better than computers -

Air traffic control requires human oversight.

Signing off

Asian markets rose this morning following the rally on Wall Street. Benchmarks advanced in Hong Kong and Japan. The Nikkei is a few percentage points away from its 1989 highs. The Taiwanese market reached an intraday record high, thanks to TSMC which rose 8%.

US equity futures are unchanged pre-market. The Rand is trading at R19.07 to the US Dollar.

We'll see earnings reports out today from Applied Materials, Deere & Co, DoorDash, and The Trade Desk.

We will be back with more news and views tomorrow. Have a good day.

Sent to you by Team Vestact.