Market scorecard

US markets closed lower last night following slightly hotter-than-expected US inflation numbers. This means that the Fed's work to tame inflation is not done and the pivot to cutting interest rates has been pushed out by a few months. The news dragged down all eleven sectors of the S&P 500. Since we've been at all-time highs, weaker trading days are sometimes ascribed to "profit taking".

In January, US consumer prices saw a 0.3% increase compared to the previous month. Core prices, which exclude volatile categories such as food and energy, rose by 0.4%. This is probably nothing to worry about, just a blip in the road.

In company news, JetBlue shares took off by 22% after activist investor Carl Icahn announced that he had built up a 10% stake. Elsewhere, Shopify dropped over 13% following disappointing earnings guidance. Lastly, credit ratings agency Moody's fell 7.9% as sales and profits fell short of analyst forecasts.

At the market close, the

JSE All-share was down 0.89%, the

S&P 500 fell 1.37%, and the

Nasdaq was 1.80% lower. Ugh!

Our 10c worth

One thing, from Paul

Misguided government plans can have devastating economic consequences. This statement won't come as a surprise to South African readers - the cadres of the ruling African National Congress have stuck grimly to their state-led development policies in the last decade. Those resulted in loadshedding, clogged ports, broken trains, bad public education and widespread unemployment.

The best example of bad economic ideas leading to shocking outcomes is

Mao Zedong's disastrous Great Leap Forward in China from 1958 to 1962.

According to this analysis, it resulted in 36 million deaths, some estimates are as high as 55 million. That episode is known (in the West only) as the Great Chinese Famine.

We have an election coming up soon in this country, and the outcome is less certain than ever. A coalition in parliament is likely, and every vote will count.

Now would be a good time to get involved in local party politics, in your area.

Byron's beats

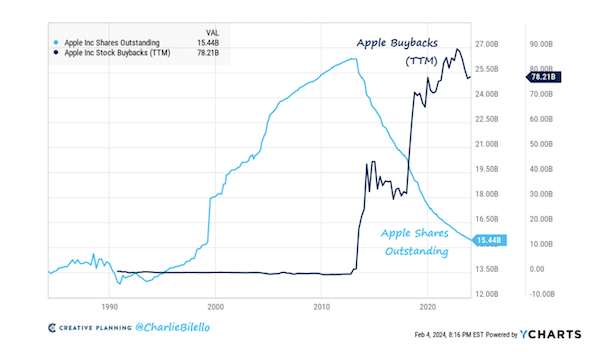

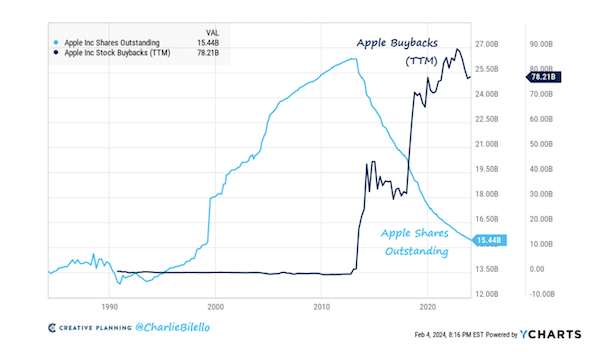

Here's a beautiful picture for Valentine's Day. The graph below shows Apple's shares in issue in light blue and the value of its share buybacks in dark blue.

In total, Apple has bought back $619 billion in stock over the last 10 years. During that period the share price has gone from $18 to $180. A solid 10 bagger.

If you were a shareholder over that period, it meant you owned an ever higher percentage of the company without having to buy more shares. A large portion of Apple's fantastic share price performance over the last decade can be attributed to these well-timed buybacks. Dividends are nice but buybacks are better.

Michael's musings

History shows that the S&P 500 drops by more than 30% once every 5 to 7 years. However, in the last four years, we've had two falls of that magnitude. I was joking with a client recently that this means we won't see another crash for at least another 10 years!

Jokes aside, we have no idea what the short term will hold for the market.

Record highs generally lead to more record highs. Humanity pushes forward, we do more with less, and ultimately, the stock market keeps going up.

Of course, it isn't a smooth ride higher. Ben Carlson ran the numbers, and added that drops of over 20% happens every four years, on average. See here -

How often do bear markets occur?

Looking ahead at this year, global economies are stronger, and we expect a further boost when central banks start to drop interest rates. We don't see any major storm clouds on the horizon.

Bright's banter

Sony Music is acquiring a 50% stake in Michael Jackson's music catalogue for a staggering $600 million, marking it the richest music catalogue deal ever. Their previous record was the 2021 purchase of Bruce Springsteen's catalogue for $550 million.

This agreement values the entire Michael Jackson catalogue at an astounding $1.2 billion. His recorded masters catalogue features iconic hits like "Beat It" and "Bad." This deal excludes assets such as an upcoming biopic, the Broadway musical "MJ," and Jackson-themed Cirque de Soleil shows.

Despite his passing in 2009,

sales of Jackson's music grew by 37% from 2020 to 2023, outpacing the overall US music market. His estate continues to make around $75 million annually.

Linkfest, lap it up

Linkfest, lap it up

Tiger Woods has unveiled his new clothing line. He's teamed up with TaylorMade -

Sun Day Red apparel to go on sale 1 May.

Drugs are bad for you, but mental health problems are widespread Ketamine clinics are popping up all over the globe -

The new wild west.

Signing off

Asian markets are mostly down this morning. Benchmarks rose in Hong Kong where trading resumed after Lunar New Year holidays, and fell in India, Japan, and South Korea. Mainland China is still in celebration mode.

US equity futures are in the red in pre-market trading. The US Dollar has firmed up on news that interest rate cuts will be delayed, so the Rand is trading around R19.11 to the greenback.

We'll see earnings reports from Cisco Systems and Sony today. Anyone care about those two?

Have a pleasant day.

Sent to you by Team Vestact.