Market scorecard

US markets continued their steady march higher yesterday. Too lovely! Notable gains came from Meta (+3.3%), Nvidia (+2.8%), and Microsoft (+2.1%). On the flip side, the losers included Amgen (-6.4%), Gilead Sciences (-4.3%), and Comcast (-3.5%).

In company news, recently-listed chipmaker Arm Holdings rallied 19.8% in after-hours trade due to an upbeat set of numbers. Chipotle rose 7.2% to a new high after reporting strong sales of burritos and guacamole. Over in Hong Kong, Alibaba dropped 7% despite announcing a $25 billion share buyback programme. Lastly, Snap shares tanked 35% because the social media company reported slowing user growth and weak ad sales.

At the close, the

JSE All-share gave up 0.33%, but the

S&P 500 rose 0.82%, and the

Nasdaq cruised 0.95% higher.

Our 10c worth

Bright's banter

Medical device company Stryker demonstrated a robust performance in the fourth quarter, with reported net sales increasing by 11.8% to $5.8 billion thanks to rising demand for elective surgeries. Stryker has been a Vestact-recommended stock since January 2014, exactly a decade ago.

For the full year, Stryker reported sales growth of 11.1% to $20.5 billion. Operating margins remained healthy, with earnings per share showing a very pleasing growth of 33.7% to $8.25.

Management attributed the strong performance to the

MedSurg and Neurotechnology segment which grew by 12.1% in 2023, as well as the Orthopaedics and Spine segment which added 11.1% for the year.

Looking ahead to 2024,

Stryker expects continued sales momentum, with strong procedural volumes and healthy demand for capital products. The company forecasts organic net sales growth to be in the range of 7.5% to 9.0% and adjusted net earnings per share to be in the range of $11.70 to $12.00.

We remain optimistic that Stryker will be able to build on its solid performance thanks to their commitment to innovation in the medical technology sector. It also helps that all the supply chain pressures are a thing of the past.

The company's shares are up 28% in the last year and they continue to be our favourite investment in the sector. The picture below shows the Mako robotic surgery system, one of their best-sellers.

One thing, from Paul

Bernard Baruch made a fortune as a broker on the New York Stock Exchange in the early 1900s. He went on to work for President Woodrow Wilson as head of the US War Industries Board during WW1, and also advised President Franklin Roosevelt during WW2.

Eddy Elfenbein related a good line from Baruch (pictured below):

"

Above all else the stock market is people. It is people trying to read the future. And it is this intensely human quality that makes the stock market so dramatic an arena, in which men and women pit their conflicting judgements, their hopes and fears, strengths and weaknesses, greeds and ideals."

That's why I love being a professional investor. There's never a dull day in this business. Finding, accumulating and patiently holding shares of high-quality companies is a great challenge.

I can't imagine a better thing to do with my time.

I hope to be behind my desk at Vestact for the next three decades, at least.

Byron's beats

During the recent Google results coverage, I mentioned how AI is helping advertisers improve their conversion rates. Two weeks ago, Google announced the expansion of Gemini (their most capable AI model) into Google Ads. Beta access is now available in the US and UK and will be rolled out to global English-language advertisers over the coming weeks.

The chat-based service helps build higher quality search campaigns, backed by a metric they have created called Ad Strength, which looks at relevance, quality and diversity.

If you need to promote your own website or are generally just interested in online advertising, go have a look at the release on the

Google blog.

The future is bright for Google Ads.

Michael's musings

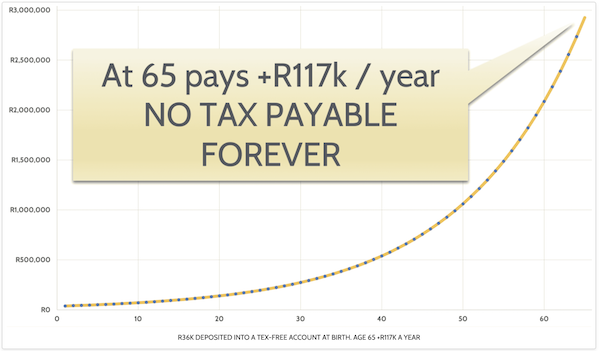

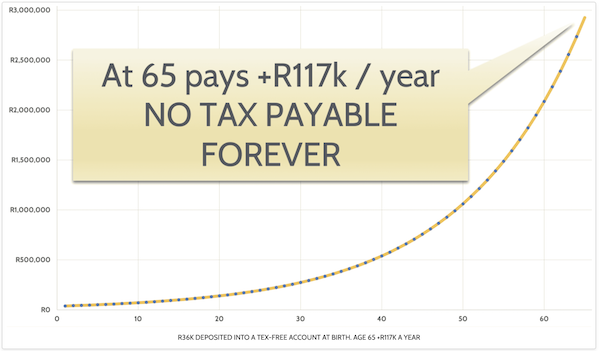

Simon Brown from Just One Lap did the maths on the long-term benefits of having a tax-free investment account. If you have kids, it is a great way to put a little money aside now to make a huge difference in their retirement. You can read the article here -

Tax-free investing upside.

To recap, every South African is able to put R36 000 a year away in a tax-free savings/ investment vehicle. There is a lifetime contribution limit of R500 000, and both of those numbers will probably be adjusted to account for inflation at some point. Once the money is in the vehicle, there is no tax - no dividend tax, income tax or capital gains tax. You do need to use after-tax income though to make the contributions.

A key thing to note is if you take money out of the tax-free vehicle, it doesn't roll back the annual or lifetime allocation limits. For example, if you put R36 000 in today and then take it out again in a month, you can't put another R36 000 in until the new tax year.

Given that you are using after-tax money and that the annual contribution limits are low, the product only makes sense for very, very long-term money. It means that you shouldn't waste your very valuable annual allowance on short-term savings. It makes me mad when I see financial institutions advertising tax free savings accounts as a way to save for things like weddings - they should lose their license for false advertising. A complete waste and misuse of the tax-free product.

If you are going to use the tax-free investment account, set up a monthly debit order, put it all into the S&P 500 index tracker, and then do nothing for the next 20 years. Simple.

Linkfest, lap it up

Linkfest, lap it up

Ever heard of the 'Enhanced Games'? Athletes are allowed to juice to their heart's content -

Peter Thiel bankrolls Olympics on steroids.

The goal is to become an inter-planetary species. To do that, we need to understand how our bodies work in orbit -

Russian Cosmonaut sets new record for days spent in space.

Signing off

Asian markets are mostly higher this morning with the MSCI Asia-Pacific Index up for a third day in a row. Benchmarks rose in India, Japan, mainland China, and South Korea while Hong Kong lagged. China will begin its Lunar New Year celebrations from tomorrow, so those markets will be closed for about a week.

Consumer prices in China saw their most rapid decline last month since the global financial crisis, underscoring the challenges faced by the world's second-largest economy in combating persistent deflationary forces.

US equity futures are unchanged in early trade. That means that no one has any firm ideas about the direction of US markets later today. Companies reporting earnings include S&P Global, Unilever, AstraZeneca, and J&J's spinoff called Kenvue.

The Rand is trading around R18.88 to the US Dollar

It's a lovely hot summer day in Joburg. Have a good one, make it count.

Sent to you by Team Vestact.