Last week our medical technology holding Stryker reported solid numbers. Sales increased by 11.2% to $5 billion which resulted in an adjusted earnings per share increase of 12.9% to $2.54. They expect to make just over $10 a share for the full year. That puts the stock on a forward multiple of 28 times earnings. This is pretty standard for a quality operation showing consistent growth in a thriving industry.

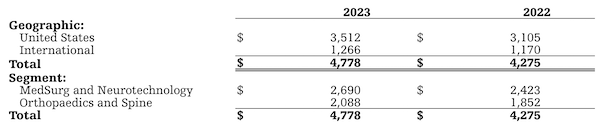

They break their business up into two segments, MedSurg and Neurotechnology (56% of sales) and Orthopaedics and Spine (44% of sales). Both segments grew by more than 11% in the quarter. The image below shows you the geographic and segmental makeup of their sales.

The share price has had a good run since July 2022, up 33% over the last 12 months. Over the last 5 years it has outperformed the S&P by 14%. The company has a world-renowned distribution and sales team and they are consistently developing or buying new products to add to their product catalogue.

The number of elective surgeries has exploded since the end of the Covid pandemic, and the momentum does not look like slowing down. A massive global middle class is getting older but they want to maintain their standard of living, through corrective surgery and joint replacements. Stryker products are right there to meet that need. This stock is a fantastic option for healthcare exposure in your portfolio.