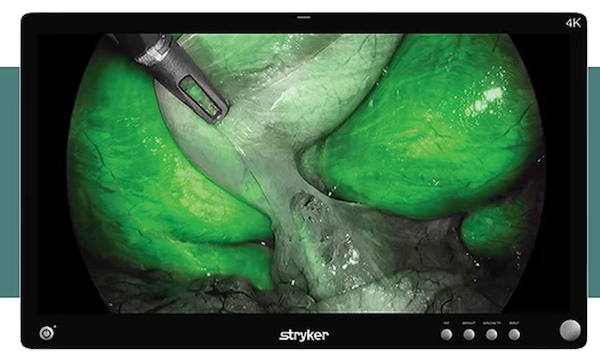

On Monday night, Stryker, the medical device business, released their numbers for the third quarter of the year. My son had his tonsils taken out the other day. Whilst in the theatre I was pleased to see a Stryker surgical monitor (like the picture below), which was linked to Stryker equipment used to perform the surgery. All went well.

Ok back to the numbers. Organic sales, up 9.9%, beat expectations despite supply issues. Net sales increased 7.7% to $4.5 billion. Earnings per share decreased by 3.3% thanks to a stronger dollar and margins that were under pressure due to inflation.

Having now seen 3 out of the 4 quarters, they have adjusted their sales expectations for the full year, to growth of 8.5%-9%. The stronger dollar at current levels will have a 4% impact on sales growth. Earnings per share is expected to come in at around $9.20. The stock, which dropped 4% on the day of the release, now trades at $212 a share or 23 times 2022 earnings.

The company is expected to grow around 10% per annum and operates in a sector that is constantly gaining clients (old people). They have exposure to knees, hips, spine, instruments, endoscopy, emergency care, neurovascular and more. The stock is down 19% so far this year, which is slightly better than the S&P. We think the share is fairly priced and should have a medium-sized (around 5%) weighting in your portfolio.