JP Morgan announced that it will be acquiring ESG investing platform OpenInvest as it ventures into the sustainable investing market. This is Jamie Dimon's third fintech acquisition over the past seven months. The terms of this deal were not disclosed.

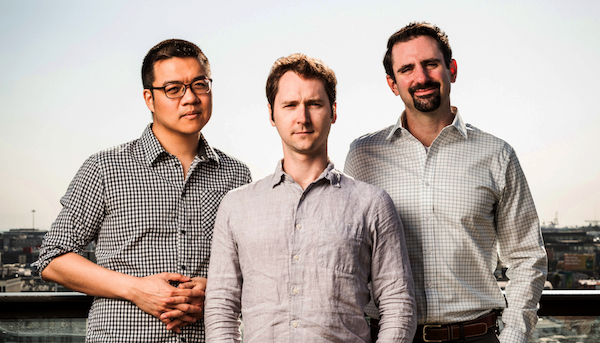

OpenInvest is a San Francisco-based startup that was founded by former Bridgewater Associates employees Joshua Levin, Conor Murray, and Phillip Wei with the goal to deliver technology that helps values-based investing. They wanted to help advisors build, manage, and report on ESG portfolios.

OpenInvest will retain its own brand and be integrated in JP Morgan's Private Bank and Wealth Management offerings. This deal follows the acquisition of 55ip, a fintech company focused on delivering tax-smart investment strategies through model portfolios and the acquisition of UK-based robo-advisor Nutmeg.

ESG funds have seen record inflows as of late, pushing global assets under management to just under $2 trillion. Clients want to understand the ESG impact of their portfolios and use the information to construct portfolios aligned with their values.

This acquisition makes sense since JP Morgan's offerings stretches to about half of North American households. Millions more investors will have access to the OpenInvest platform at their fingertips. Jamie Dimon is on a mission and we love to see it!