Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

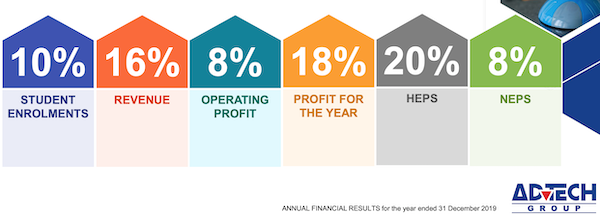

On Monday Advtech released their full year numbers, for the year ending December 2019. Back when the only thing to worry about was if Liverpool could finish the season unbeaten. Here is a summary of their results.

Overall, not bad in a low growth environment. The company noted that they lost 928 students due to emigration and then a further 1 000 due to parents having financial difficulties. Students leaving in the middle of a school year, or in the middle of a school phase are difficult to replace, and their school fees come straight off the bottom line of the company. There is still a massive opportunity in private education though.

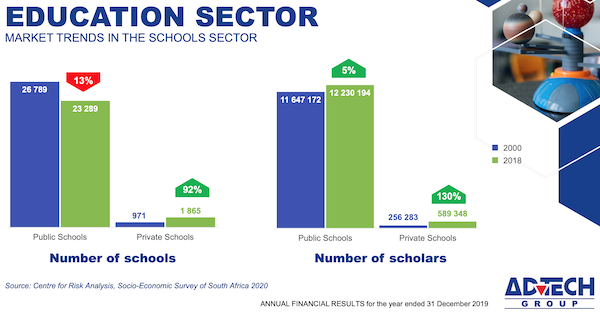

Looking at the stats above, it shows how much room there is for private schools to operate in South Africa. The other thing to notice is the huge increase of new private schools - schools who in many cases are a direct competitor to Advtech. You can see the impact of increased competition on capacity figures. In 2017 Advtech was at an 86% capacity, now the group is at 79%. The silver lining is that there is room for solid growth without needing much capital expenditure.

Looking at the group as a whole, their Tertiary division is still the stand out segment. It accounts for 57% of profits and only 42% of revenue. The higher education space is also seeing deregulation, which gives them further scope to broaden their offering.

Schooling is one of the sectors most under fire with the Covid-19 shutdown, and as such Advtech's share price has been hit hard. Given how far the share price has dropped, management are now considering doing a share buyback once the Covid-19 threat is under control. Doing a share buyback before then would be irresponsible. It has been a rough time as a shareholder, but this too shall pass.