Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Illumina is a company doing amazing things. Take a look at their latest product, the NextSeq 2000.

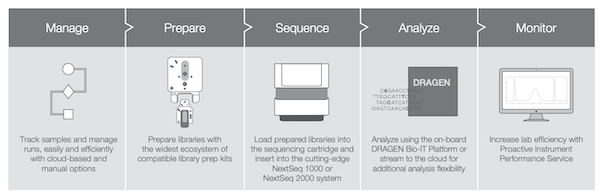

That beautiful device uses the latest advances in optics, instrument design, and reagent chemistry to miniaturise the volume of the sequencing reaction while increasing output and reducing the cost per run. The genetics sequencing system is used for oncology, genetic disease, reproductive health and even genomics products for agricultural application. Here is the process.

One of those devices costs $335 000. Sales of the NextSeq range made up a large portion of the company's $953 million of quarterly revenue. $812m of that was from product sales and $141 was from services.

For the full year 2019 sales increased 6% to $3.3bn. This resulted in net income of $1bn. A very profitable company despite spending 18% of revenues on Research & Development. Cash flows were solid, the company now sits on $2bn in cash. They are about a quarter way through a $290m share buy back programme.

The stock trades at 45 times forward earnings. When we first started buying Illumina in 2018 it was trading at 55 times earnings. We have seen a nice PE compression but unfortunately not much share price growth. We see that as an opportunity.

Earnings can be lumpy depending on the sales of these very expensive items. Initiatives like 23andMe also spike demand which then tapers off quickly.

We have no doubt that preventative healthcare measures like genetics sequencing has a huge part to play in the future of humanity. Get in before it's too late!